9. CHAPTER 09. MODELS WITH NATURAL LOGARITHMS#

SET UP

library(foreign) # to open stata.dta files

library(psych) # for better sammary of descriptive statistics

library(repr) # to combine graphs with adjustable plot dimensions

options(repr.plot.width = 12, repr.plot.height = 6) # Plot dimensions (in inches)

options(width = 150) # To increase character width of printed output

9.1. 9.4 EXAMPLE: EARNINGS AND EDUCATION#

df = read.dta(file = "Dataset/AED_EARNINGS.DTA")

attach(df)

print(describe(df))

print(head(df))

vars n mean sd median trimmed mad min max range skew kurtosis se

earnings 1 171 41412.69 25527.05 36000 38052.70 17049.90 1050 172000 170950 1.70 4.23 1952.10

education 2 171 14.43 2.74 14 14.45 2.97 3 20 17 -0.45 1.16 0.21

age 3 171 30.00 0.00 30 30.00 0.00 30 30 0 NaN NaN 0.00

gender 4 171 0.00 0.00 0 0.00 0.00 0 0 0 NaN NaN 0.00

earnings education age gender

1 25000 14 30 0

2 40000 12 30 0

3 25000 13 30 0

4 38000 13 30 0

5 28800 12 30 0

6 31000 16 30 0

Create variables and add to data frame

lnearn = log(earnings)

df$lnearn = lnearn

lneduc = log(education)

df$lneduc = lneduc

9.1.1. Table 9.2#

table92vars = c("earnings", "lnearn", "education", "lneduc")

print(describe(df[table92vars]))

vars n mean sd median trimmed mad min max range skew kurtosis se

earnings 1 171 41412.69 25527.05 36000.00 38052.70 17049.90 1050.00 172000.00 170950.0 1.70 4.23 1952.10

lnearn 2 171 10.46 0.62 10.49 10.47 0.54 6.96 12.06 5.1 -0.90 4.74 0.05

education 3 171 14.43 2.74 14.00 14.45 2.97 3.00 20.00 17.0 -0.45 1.16 0.21

lneduc 4 171 2.65 0.22 2.64 2.66 0.20 1.10 3.00 1.9 -2.42 13.27 0.02

9.1.2. Table 9.3#

Linear model

ols.linear <- lm(earnings ~ education)

library(jtools)

summ(ols.linear, digits=3)

MODEL INFO:

Observations: 171

Dependent Variable: earnings

Type: OLS linear regression

MODEL FIT:

F(1,169) = 68.857, p = 0.000

R² = 0.289

Adj. R² = 0.285

Standard errors:OLS

----------------------------------------------------------

Est. S.E. t val. p

----------------- ------------ ---------- -------- -------

(Intercept) -31055.915 8887.835 -3.494 0.001

education 5021.123 605.101 8.298 0.000

----------------------------------------------------------

Log-linear Model

summ(ols.loglin <- lm(lnearn ~ education), digits=3)

MODEL INFO:

Observations: 171

Dependent Variable: lnearn

Type: OLS linear regression

MODEL FIT:

F(1,169) = 84.743, p = 0.000

R² = 0.334

Adj. R² = 0.330

Standard errors:OLS

--------------------------------------------------

Est. S.E. t val. p

----------------- ------- ------- -------- -------

(Intercept) 8.561 0.210 40.825 0.000

education 0.131 0.014 9.206 0.000

--------------------------------------------------

Log-log Model

summ(ols.loglog <- lm(lnearn ~ lneduc), digits=3)

MODEL INFO:

Observations: 171

Dependent Variable: lnearn

Type: OLS linear regression

MODEL FIT:

F(1,169) = 67.668, p = 0.000

R² = 0.286

Adj. R² = 0.282

Standard errors:OLS

--------------------------------------------------

Est. S.E. t val. p

----------------- ------- ------- -------- -------

(Intercept) 6.543 0.478 13.700 0.000

lneduc 1.478 0.180 8.226 0.000

--------------------------------------------------

Linear-log Model

summ(ols.linlog <- lm(earnings ~ lneduc), digits=3)

MODEL INFO:

Observations: 171

Dependent Variable: earnings

Type: OLS linear regression

MODEL FIT:

F(1,169) = 50.570, p = 0.000

R² = 0.230

Adj. R² = 0.226

Standard errors:OLS

------------------------------------------------------------

Est. S.E. t val. p

----------------- ------------- ----------- -------- -------

(Intercept) -102767.278 20347.617 -5.051 0.000

lneduc 54452.483 7657.259 7.111 0.000

------------------------------------------------------------

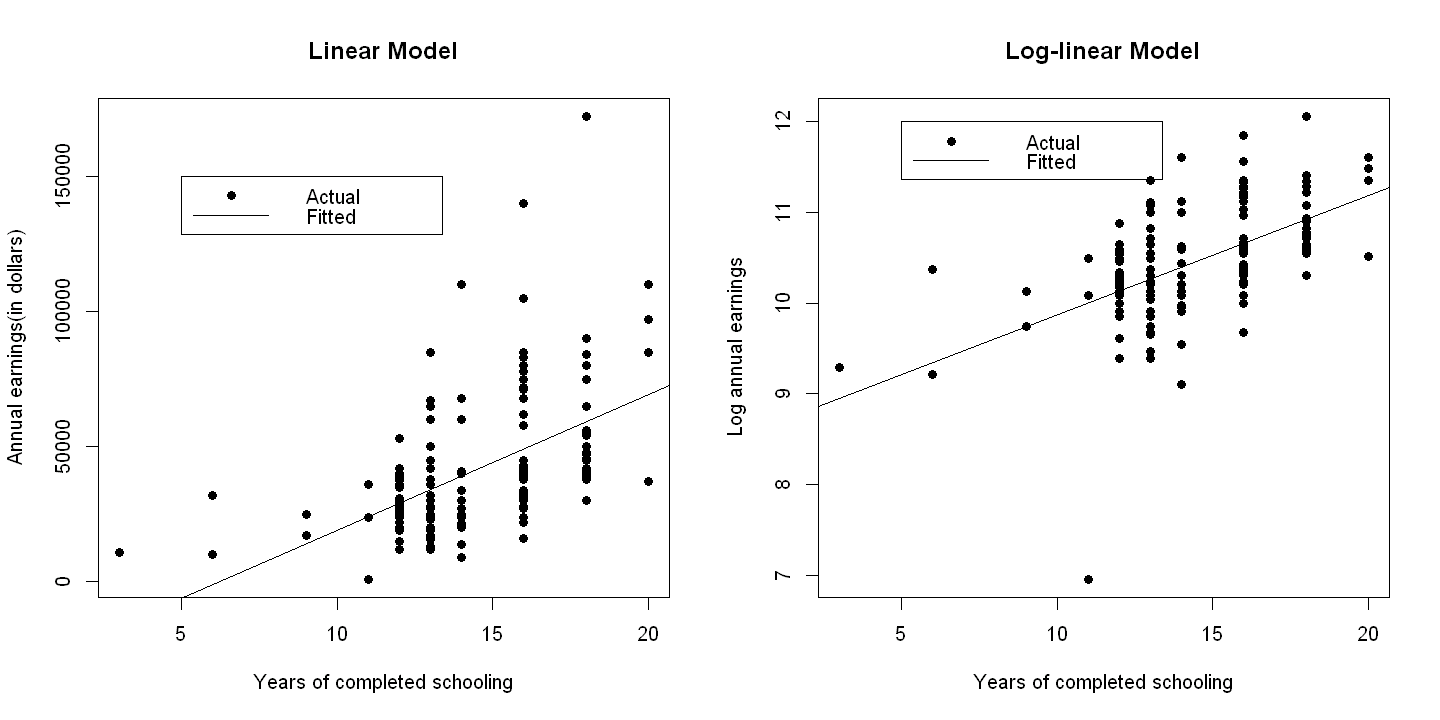

9.1.3. Figure 9.1#

par(mfrow = c(1,2))

# first panel

plot(education,earnings, xlab="Years of completed schooling",

ylab="Annual earnings(in dollars)",pch=19,main="Linear Model")

abline(ols.linear)

legend(5, 150000, c("Actual", "Fitted"), lty=c(-1,1), pch=c(19,-1), bty="o")

# second panel

plot(education,lnearn, xlab="Years of completed schooling",

ylab="Log annual earnings",pch=19,main="Log-linear Model")

abline(ols.loglin)

legend(5, 12, c("Actual", "Fitted"), lty=c(-1,1), pch=c(19,-1), bty="o")

9.2. 9.5 FURTHER USES OF THE NATURAL LOGARITHM#

9.2.1. Table 9.5#

rm(list=ls())

df = read.dta(file = "Dataset/AED_SP500INDEX.DTA")

attach(df)

print(describe(df))

print(head(df))

vars n mean sd median trimmed mad min max range skew kurtosis se

year 1 93 1973.00 26.99 1973.00 1973.00 34.10 1927.00 2019.00 92.00 0.00 -1.24 2.80

sp500 2 93 473.66 710.75 96.47 325.68 123.34 6.92 3230.78 3223.86 1.77 2.58 73.70

lnsp500 3 93 4.82 1.80 4.57 4.79 2.34 1.93 8.08 6.15 0.16 -1.27 0.19

year sp500 lnsp500

1 1927 17.66 2.871302

2 1928 24.35 3.192532

3 1929 21.45 3.065725

4 1930 15.34 2.730464

5 1931 8.12 2.094330

6 1932 6.92 1.934416

To predict exponential growth in the graph in levels

summ(ols.logs <- lm(lnsp500 ~ year))

plnsp500 = predict(ols.logs)

MODEL INFO:

Observations: 93

Dependent Variable: lnsp500

Type: OLS linear regression

MODEL FIT:

F(1,91) = 2070.52, p = 0.00

R² = 0.96

Adj. R² = 0.96

Standard errors:OLS

--------------------------------------------------

Est. S.E. t val. p

----------------- --------- ------ -------- ------

(Intercept) -124.09 2.83 -43.80 0.00

year 0.07 0.00 45.50 0.00

--------------------------------------------------

Correct for retransformation bias - see chapter 15.6. First need \(rmse^2\) the square of the root mean squared error. Code here uses knowledge that \(k = 2\)

ResSS = c(crossprod(ols.logs$residuals))

MSE = ResSS / (length(ols.logs$residuals) - 2)

sqrt(MSE)

psp500 = exp(plnsp500)*exp(MSE/2)

MSE

0.371732757916085

0.138185243307899

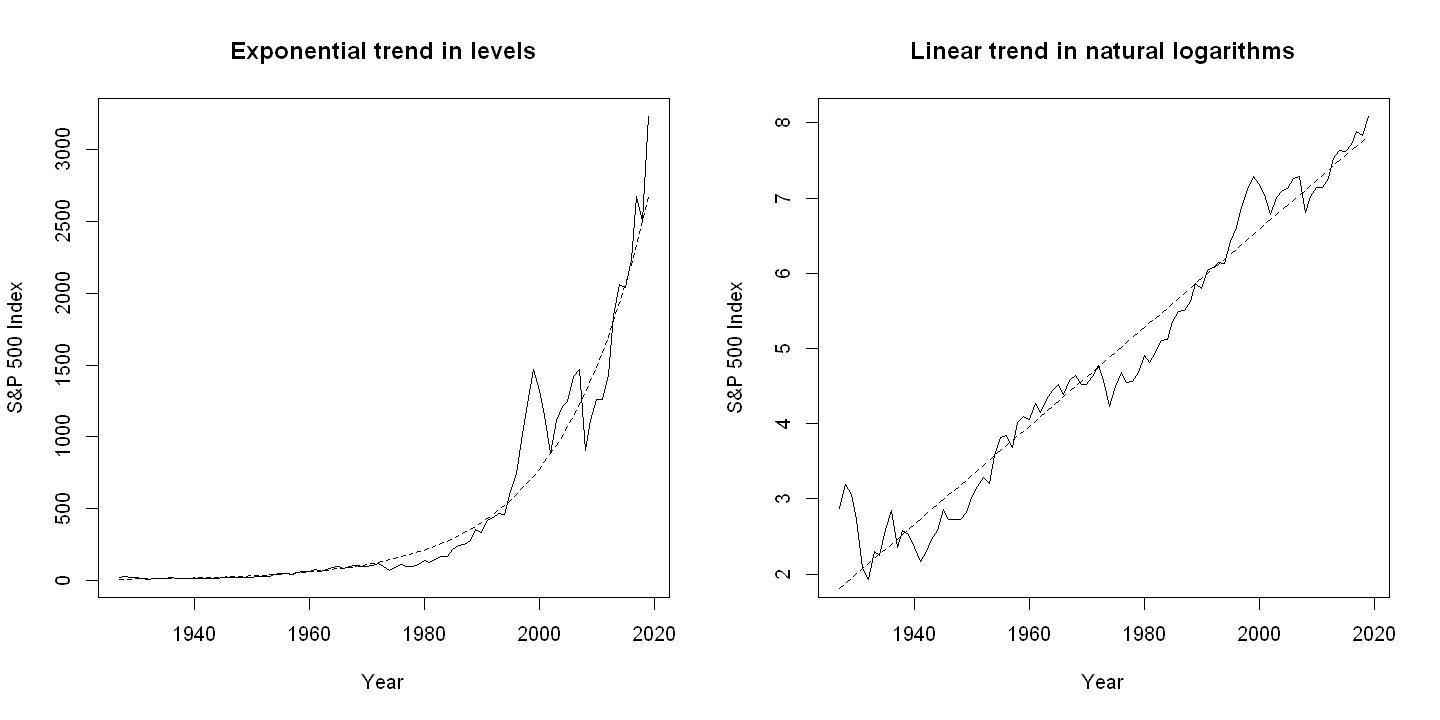

9.2.2. Figure 9.2#

par(mfrow = c(1,2))

# first panel

plot(year, sp500, xlab="Year", ylab="S&P 500 Index", type="l",lty=1,

main="Exponential trend in levels")

points(year, psp500, type="l",lty=2)

# second panel

plot(year, lnsp500, xlab="Year", ylab="S&P 500 Index", type="l",lty=1,

main="Linear trend in natural logarithms")

points(year, plnsp500, type="l",lty=2)