5. CHAPTER 5. BIVARIATE DATA SUMMARY#

SET UP

library(foreign) # to open stata.dta files

library(psych) # for better sammary of descriptive statistics

library(repr) # to combine graphs with adjustable plot dimensions

options(repr.plot.width = 12, repr.plot.height = 6) # Plot dimensions (in inches)

options(width = 150) # To increase character width of printed output

5.1. 5.1 EXAMPLE: HOUSE PRICE AND SIZE#

rm(list=ls())

df = read.dta(file = "Dataset/AED_HOUSE.DTA")

attach(df)

print(describe(df))

vars n mean sd median trimmed mad min max range skew kurtosis se

price 1 29 253910.34 37390.71 244000 249296.00 22239.00 204000 375000 171000 1.48 2.23 6943.28

size 2 29 1882.76 398.27 1800 1836.00 296.52 1400 3300 1900 1.64 3.29 73.96

bedrooms 3 29 3.79 0.68 4 3.72 0.00 3 6 3 0.92 1.89 0.13

bathrooms 4 29 2.21 0.34 2 2.16 0.00 2 3 1 1.28 0.23 0.06

lotsize 5 29 2.14 0.69 2 2.16 0.00 1 3 2 -0.17 -1.00 0.13

age 6 29 36.41 7.12 35 36.20 5.93 23 51 28 0.44 -0.75 1.32

monthsold 7 29 5.97 1.68 6 6.04 1.48 3 8 5 -0.47 -1.03 0.31

list 8 29 257824.14 40860.26 245000 252364.00 23721.60 199900 386000 186100 1.65 2.70 7587.56

5.1.1. Table 5.1#

# price and size for sample of 29 houses

sampled_data <- df[sample(nrow(df), 29), c("price", "size")]

print(sampled_data)

price size

10 235000 1600

26 279900 2000

29 375000 3300

23 272000 1800

15 244000 2000

19 255000 1500

22 270000 2000

11 236500 1600

1 204000 1400

7 230000 2100

14 241000 1600

28 340000 2400

8 233000 1700

18 253000 2100

20 258500 1600

12 238000 1900

3 213000 1800

24 273000 1900

9 235000 1700

16 245000 1400

2 212000 1600

5 224500 2100

6 229000 1700

27 310000 2300

21 270000 1800

4 220000 1600

17 249000 1900

25 278500 2600

13 239500 1600

5.1.2. Table 5.2#

summary(price)

quantile(price)

mean(price)

Min. 1st Qu. Median Mean 3rd Qu. Max.

204000 233000 244000 253910 270000 375000

- 0%

- 204000

- 25%

- 233000

- 50%

- 244000

- 75%

- 270000

- 100%

- 375000

253910.344827586

summary(size)

quantile(size)

mean(size)

Min. 1st Qu. Median Mean 3rd Qu. Max.

1400 1600 1800 1883 2000 3300

- 0%

- 1400

- 25%

- 1600

- 50%

- 1800

- 75%

- 2000

- 100%

- 3300

1882.75862068966

5.2. 5.2 TWO-WAY TABULATION#

# Create categorical variables

pricerange = price

pricerange = ifelse(price<249999, 1, 2)

sizerange = size

for (i in 1:length(sizerange)) {

if (size[i] >= 2400) {

sizerange[i] = 3

}

else if ((size[i] >= 1800)&(size[i] <= 2399)) {

sizerange[i] = 2

}

else {

sizerange[i] = 1

}

}

5.2.1. Table 5.3#

table(pricerange,sizerange)

sizerange

pricerange 1 2 3

1 11 6 0

2 2 7 3

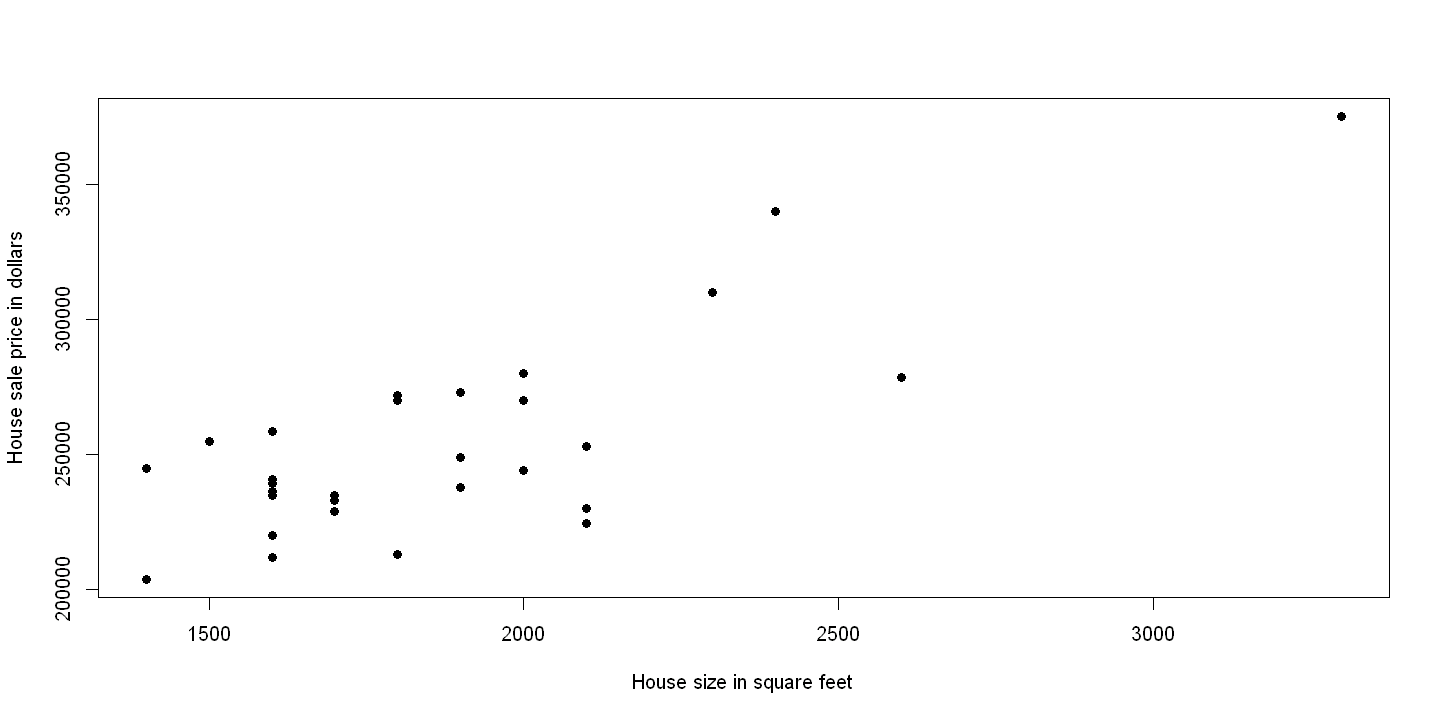

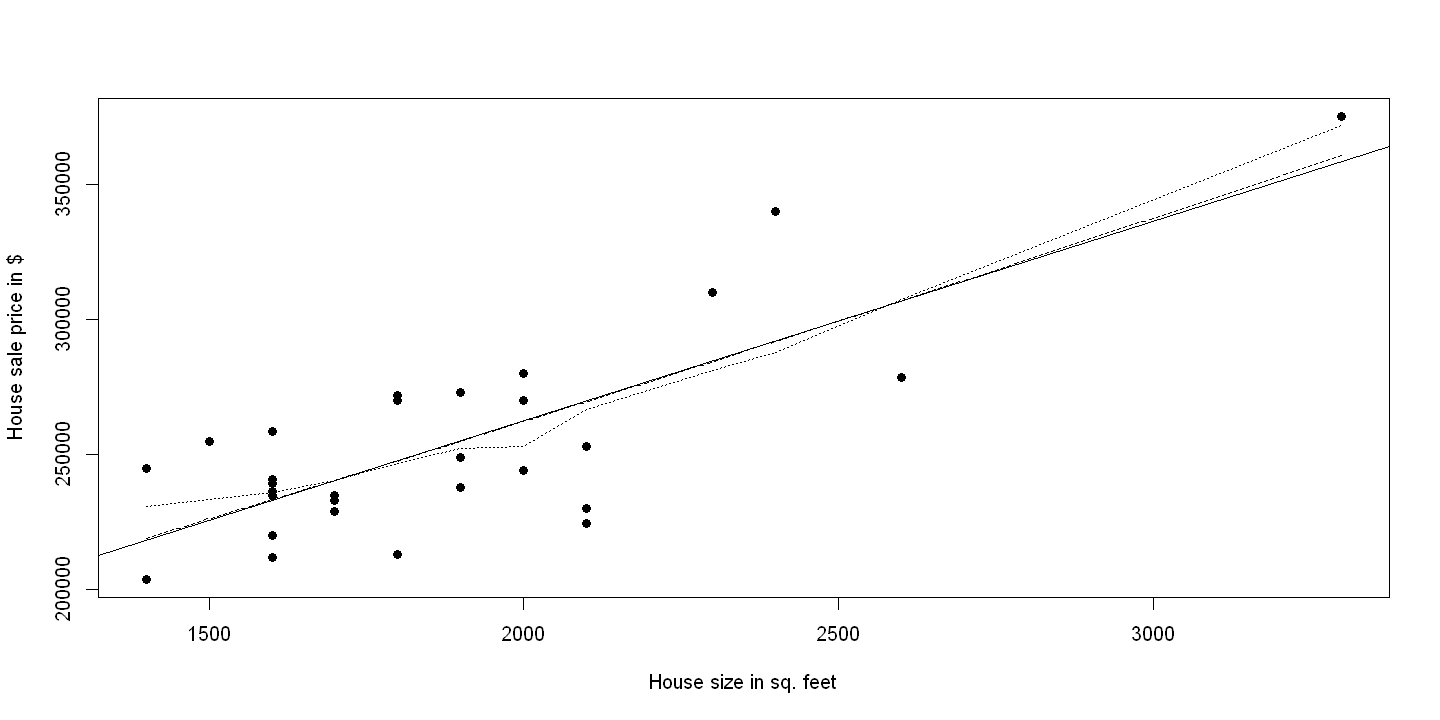

5.3. 5.3 TWOWAY SCATTER PLOT#

5.4. 5.4 CORRELATION#

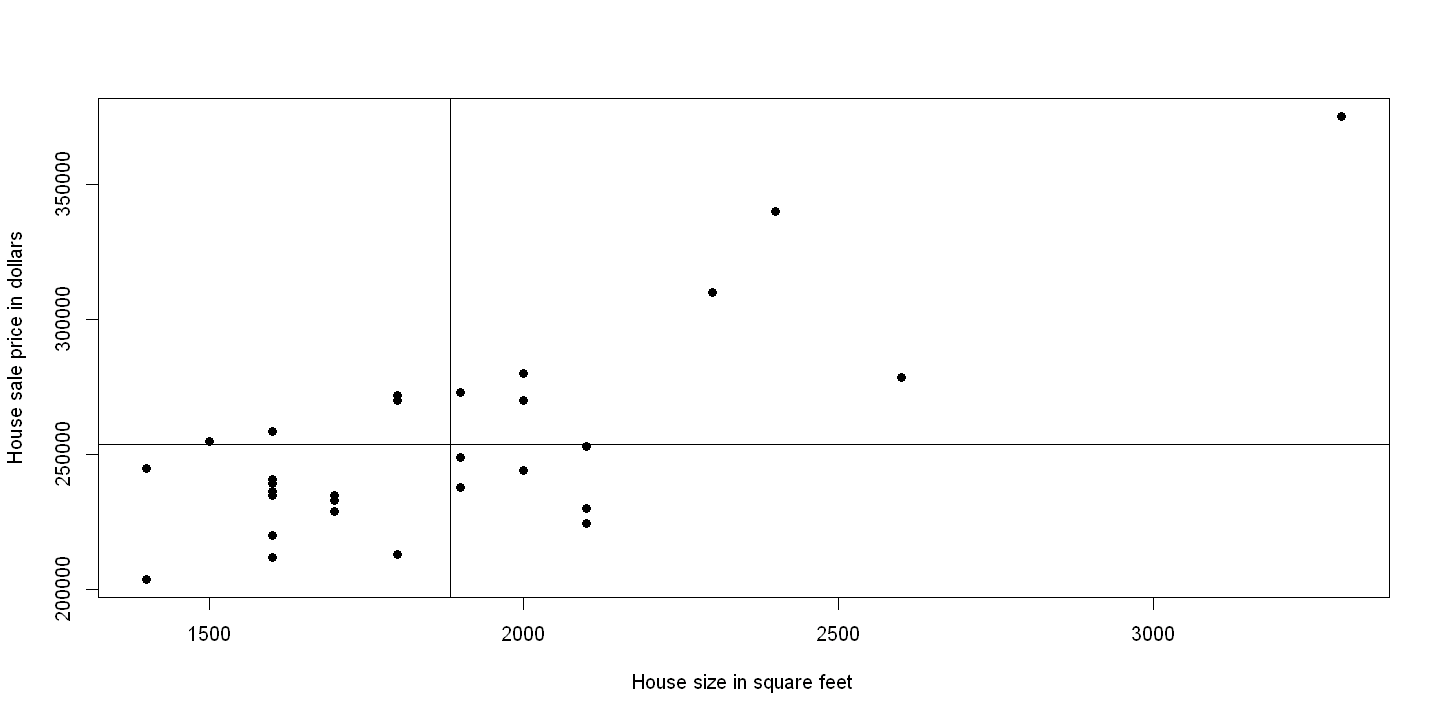

# Figure 5.1 Second panel

plot(size, price, xlab="House size in square feet", ylab="House sale price in dollars", pch=19)

abline(253910, 0)

abline(v = 1883)

# Covariance

cov(df[,1:2])

cov(price,size)

| price | size | |

|---|---|---|

| price | 1398065246 | 11701613.3 |

| size | 11701613 | 158620.7 |

11701613.3004926

# Correlation coefficient

cor(df[,1:2])

| price | size | |

|---|---|---|

| price | 1.0000000 | 0.7857821 |

| size | 0.7857821 | 1.0000000 |

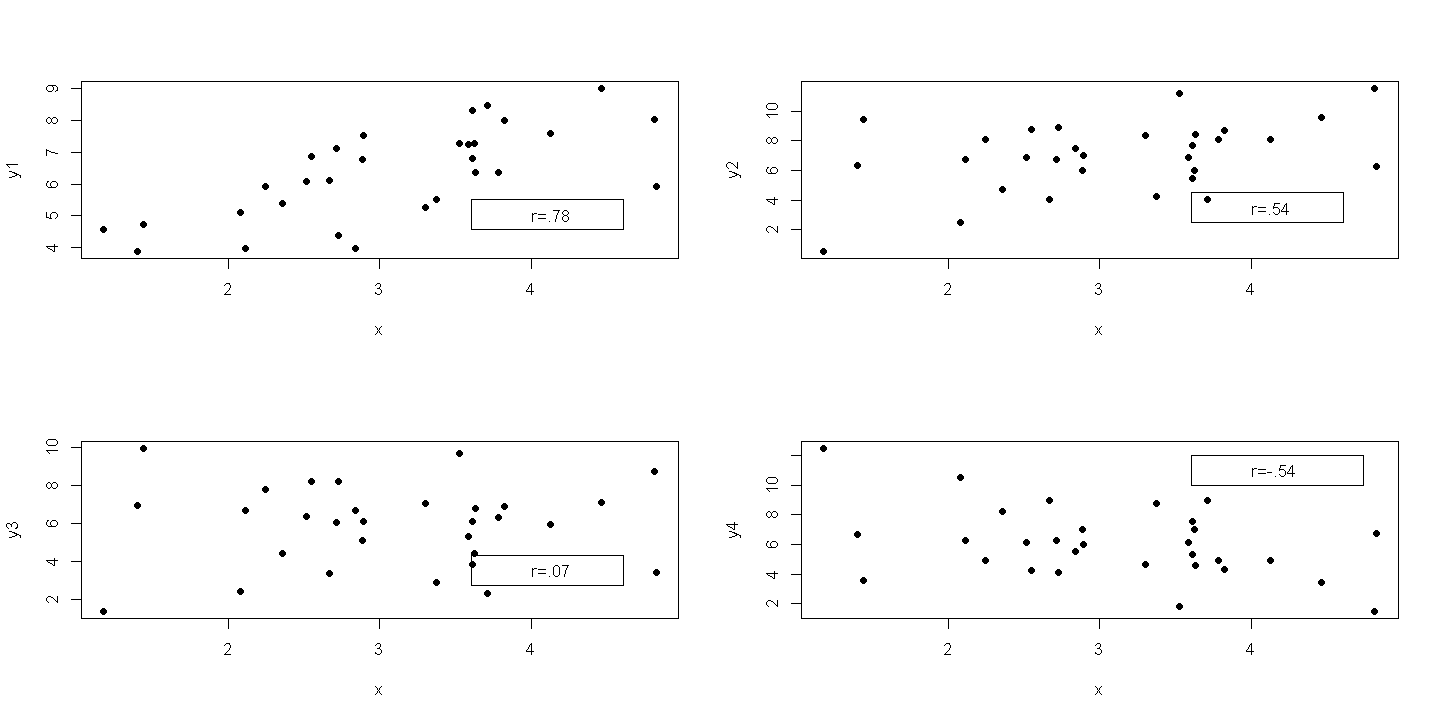

5.4.1. Plot of four cases of correlation using generated data#

# Clear the workspace

rm(list=ls())

# Set the seed number

set.seed(12345)

# Generate random data

x = rnorm(30,3,1)

u1 = rnorm(30,0,0.8)

y1 = 3 + x +u1

u2 = rnorm(30,0,2)

y2 = 3 + x + u2

y3 = 5 + u2

y4 = 10 - x - u2

cor(cbind(x,y1,y2,y3,y4))

| x | y1 | y2 | y3 | y4 | |

|---|---|---|---|---|---|

| x | 1.00000000 | 0.69802331 | 0.4175409 | 0.02760162 | -0.4175409 |

| y1 | 0.69802331 | 1.00000000 | 0.3011851 | 0.02997258 | -0.3011851 |

| y2 | 0.41754087 | 0.30118506 | 1.0000000 | 0.91983675 | -1.0000000 |

| y3 | 0.02760162 | 0.02997258 | 0.9198368 | 1.00000000 | -0.9198368 |

| y4 | -0.41754087 | -0.30118506 | -1.0000000 | -0.91983675 | 1.0000000 |

5.4.2. Figure 5.2#

5.5. 5.5 REGRESSION#

# Return to house price data, firs Clear the workspace

rm(list=ls())

ols = lm(price~size)

summary(ols)

Call:

lm(formula = price ~ size)

Residuals:

Min 1Q Median 3Q Max

-45436 -16936 1949 17818 47932

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 115017.28 21489.36 5.352 1.18e-05 ***

size 73.77 11.17 6.601 4.41e-07 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 23550 on 27 degrees of freedom

Multiple R-squared: 0.6175, Adjusted R-squared: 0.6033

F-statistic: 43.58 on 1 and 27 DF, p-value: 4.409e-07

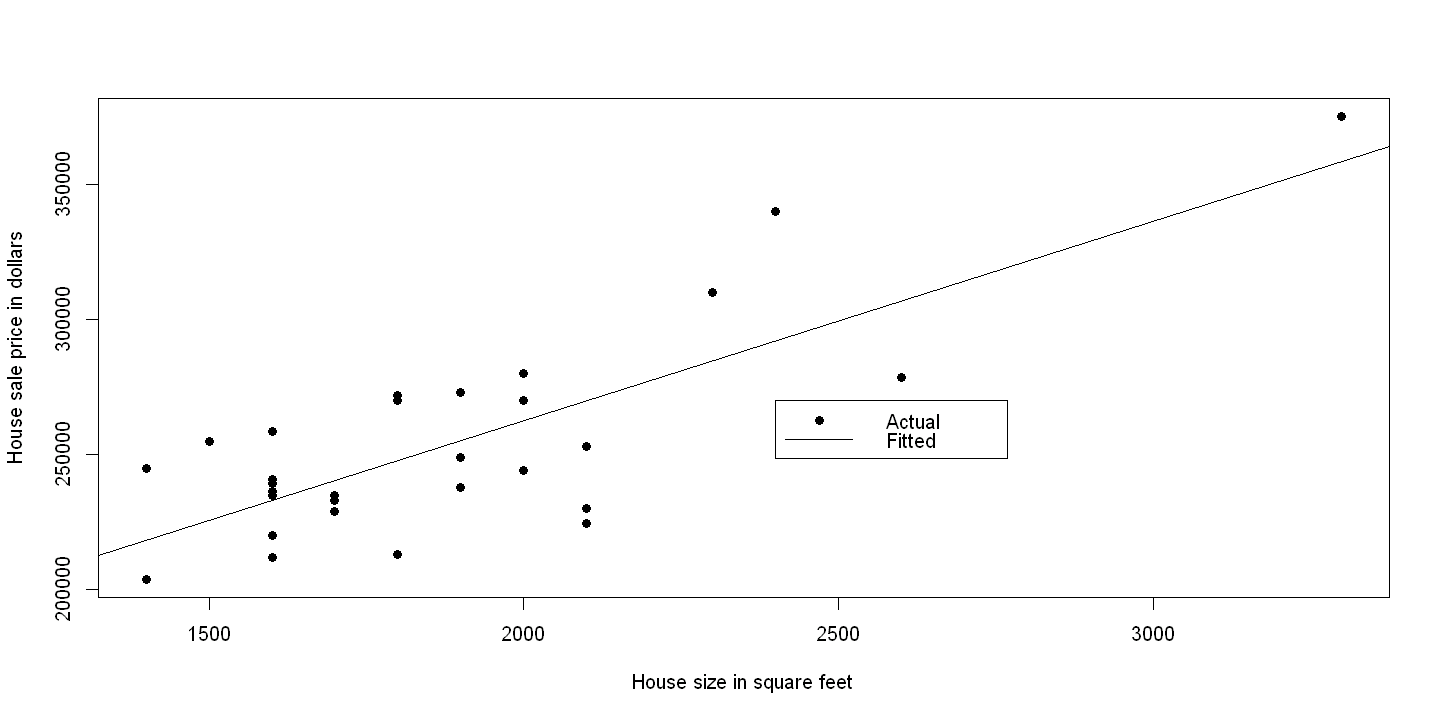

5.5.1. Figure 5.4#

plot(size,price, xlab="House size in square feet", ylab="House sale price in dollars",pch=19)

abline(ols)

legend(2400, 270000, c("Actual", "Fitted"), lty=c(-1,1), pch=c(19,-1), bty="o")

Intercept-only regression compared to the sample mean

ols.1 = lm(price~1)

summary(ols.1)

mean(price)

Call:

lm(formula = price ~ 1)

Residuals:

Min 1Q Median 3Q Max

-49910 -20910 -9910 16090 121090

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 253910 6943 36.57 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 37390 on 28 degrees of freedom

253910.344827586

5.6. 5.6 MEASURES OF MODEL FIT#

# Clear the workspace

rm(list=ls())

x = 1:5

# Generate random data

set.seed(123456)

epsilon = rnorm(5,0,2)

y = 1 + 2*x + epsilon

cbind(x, epsilon, y)

summary(y)

ols.2 = lm(y~x)

summary(ols.2)

py = predict(ols.2)

resid = y - py # ALTERNATIVELY resid = resid(ols.2)

cbind(x, epsilon, y, py, resid)

| x | epsilon | y |

|---|---|---|

| 1 | 1.6674663 | 4.667466 |

| 2 | -0.5520955 | 4.447904 |

| 3 | -0.7100037 | 6.289996 |

| 4 | 0.1749748 | 9.174975 |

| 5 | 4.5045115 | 15.504511 |

Min. 1st Qu. Median Mean 3rd Qu. Max.

4.448 4.667 6.290 8.017 9.175 15.505

Call:

lm(formula = y ~ x)

Residuals:

1 2 3 4 5

1.931 -0.929 -1.727 -1.482 2.207

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.09662 2.31705 0.042 0.9694

x 2.64012 0.69862 3.779 0.0325 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 2.209 on 3 degrees of freedom

Multiple R-squared: 0.8264, Adjusted R-squared: 0.7685

F-statistic: 14.28 on 1 and 3 DF, p-value: 0.03246

| x | epsilon | y | py | resid | |

|---|---|---|---|---|---|

| 1 | 1 | 1.6674663 | 4.667466 | 2.736739 | 1.9307278 |

| 2 | 2 | -0.5520955 | 4.447904 | 5.376855 | -0.9289502 |

| 3 | 3 | -0.7100037 | 6.289996 | 8.016971 | -1.7269744 |

| 4 | 4 | 0.1749748 | 9.174975 | 10.657087 | -1.4821119 |

| 5 | 5 | 4.5045115 | 15.504511 | 13.297203 | 2.2073086 |

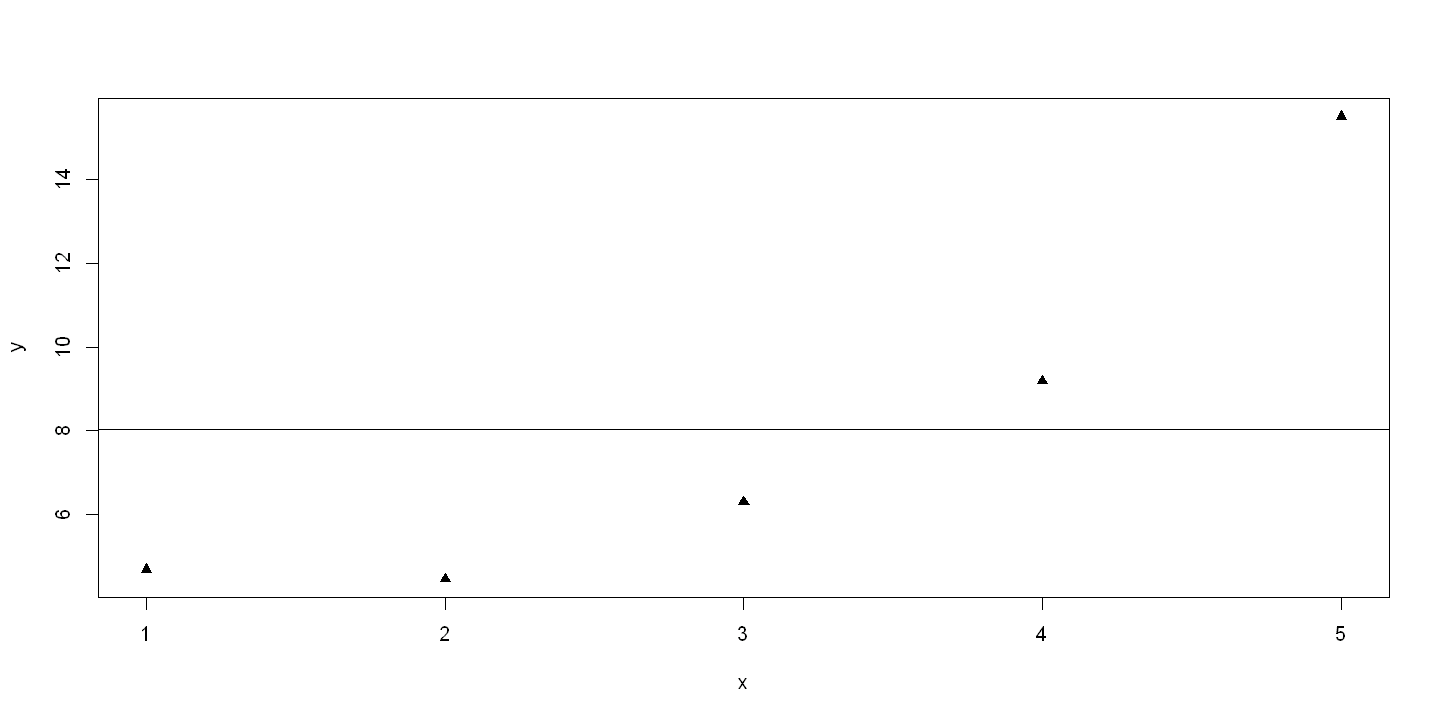

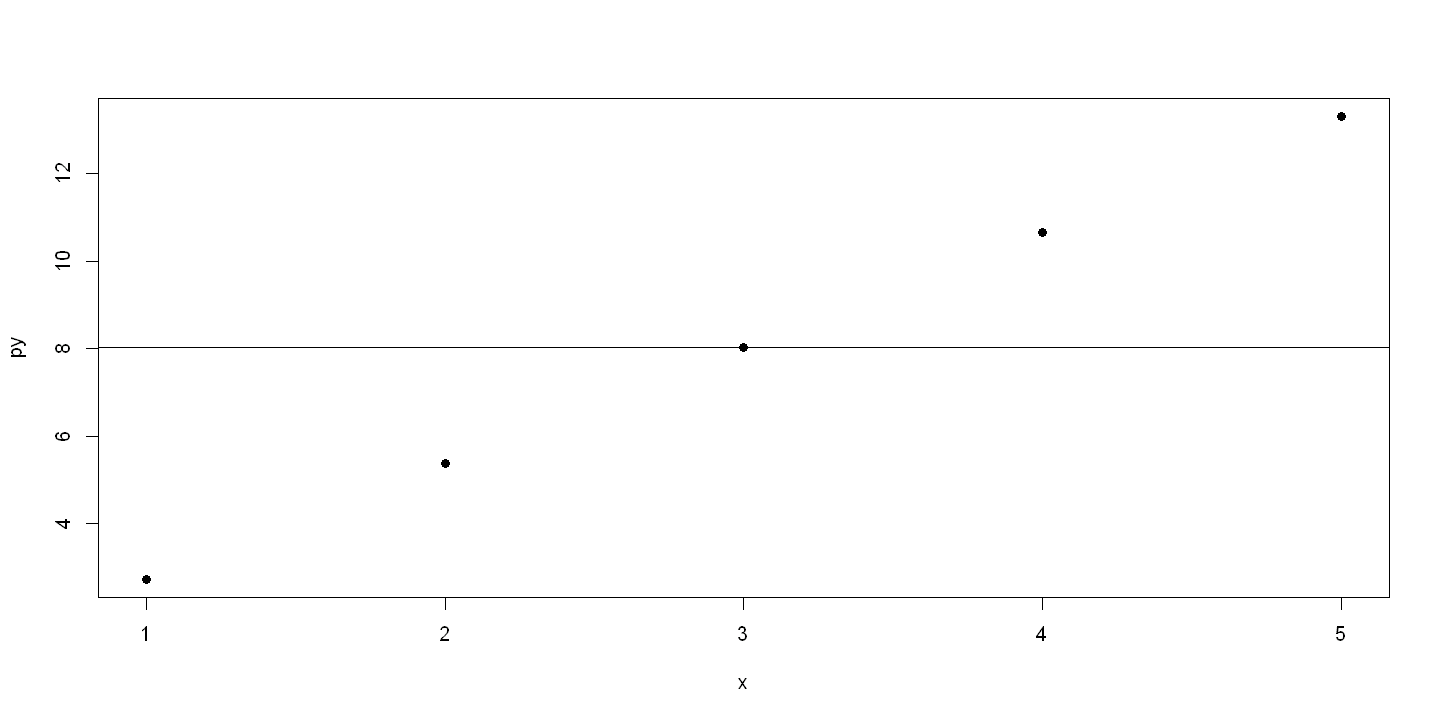

5.6.1. Figure 5.5 - Panels A and B#

5.7. 5.8 PREDICTION AND OUTLYING OBSERVATIONS#

rm(list=ls())

# df = "Dataset/AED_HOUSE.DTA")

summary(ols <- lm(price~size))

Call:

lm(formula = price ~ size)

Residuals:

Min 1Q Median 3Q Max

-45436 -16936 1949 17818 47932

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 115017.28 21489.36 5.352 1.18e-05 ***

size 73.77 11.17 6.601 4.41e-07 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 23550 on 27 degrees of freedom

Multiple R-squared: 0.6175, Adjusted R-squared: 0.6033

F-statistic: 43.58 on 1 and 27 DF, p-value: 4.409e-07

predict(ols, data.frame(size = 2000))

1: 262559.363354037

5.8. 5.10 CAUSATION#

# Reverse regression

reverse = lm(size~price)

summary(reverse)

Call:

lm(formula = size ~ price)

Residuals:

Min 1Q Median 3Q Max

-408.18 -162.15 -24.48 150.41 511.43

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -2.424e+02 3.253e+02 -0.745 0.463

price 8.370e-03 1.268e-03 6.601 4.41e-07 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 250.9 on 27 degrees of freedom

Multiple R-squared: 0.6175, Adjusted R-squared: 0.6033

F-statistic: 43.58 on 1 and 27 DF, p-value: 4.409e-07

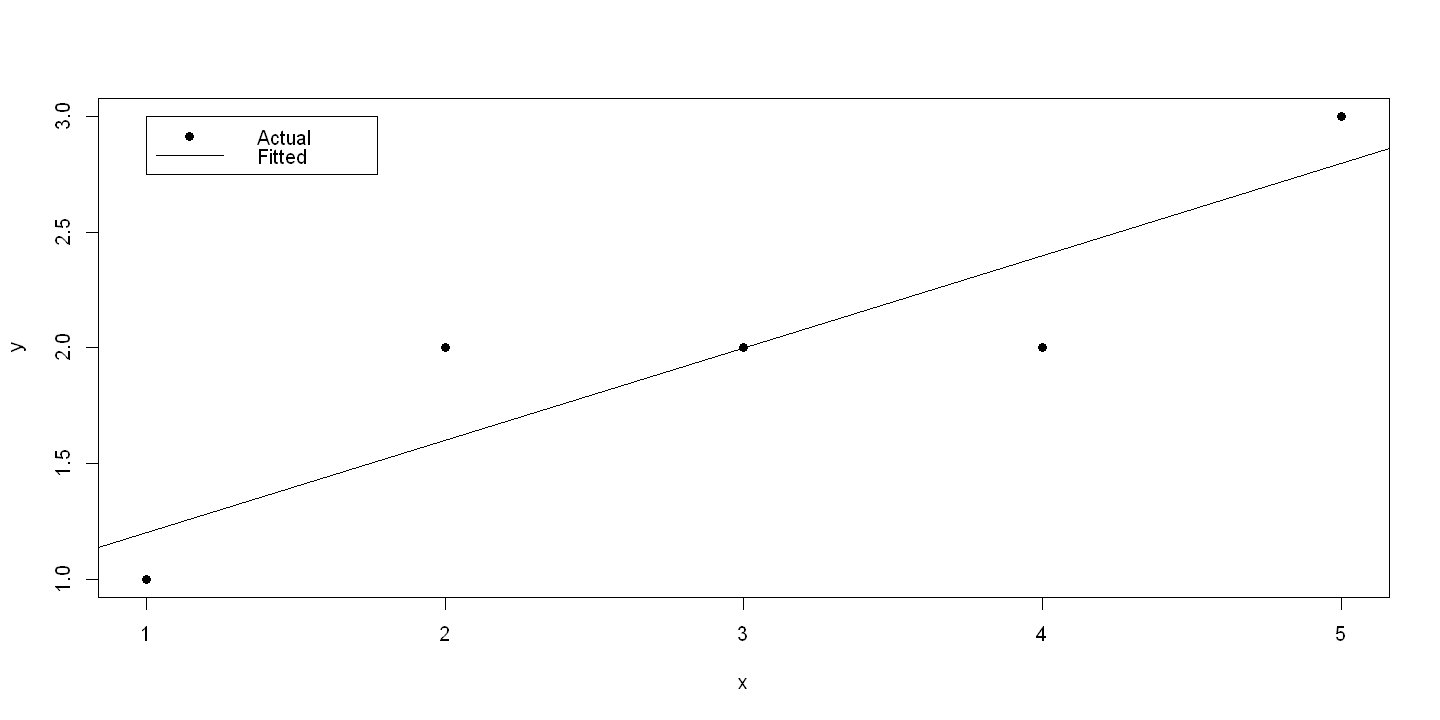

5.9. 5.11 COMPUTATIONs FOR CORRELATION AND REGRESSION#

# Create artificial data

rm(list=ls())

x = 1:5

y = c(1,2,2,2,3)

#cbind(x,y)

ols.3 = lm(y~x)

summary(ols.3)

cor(cbind(x,y)[,1:2]) # NOTE: SLIGHTLY DIFFERENT NUMBERS HERE

cor(x,y)^2

Call:

lm(formula = y ~ x)

Residuals:

1 2 3 4 5

-2.000e-01 4.000e-01 -1.457e-16 -4.000e-01 2.000e-01

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.8000 0.3830 2.089 0.1279

x 0.4000 0.1155 3.464 0.0405 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.3651 on 3 degrees of freedom

Multiple R-squared: 0.8, Adjusted R-squared: 0.7333

F-statistic: 12 on 1 and 3 DF, p-value: 0.04052

| x | y | |

|---|---|---|

| x | 1.0000000 | 0.8944272 |

| y | 0.8944272 | 1.0000000 |

0.8

5.9.1. Figure 5.5#

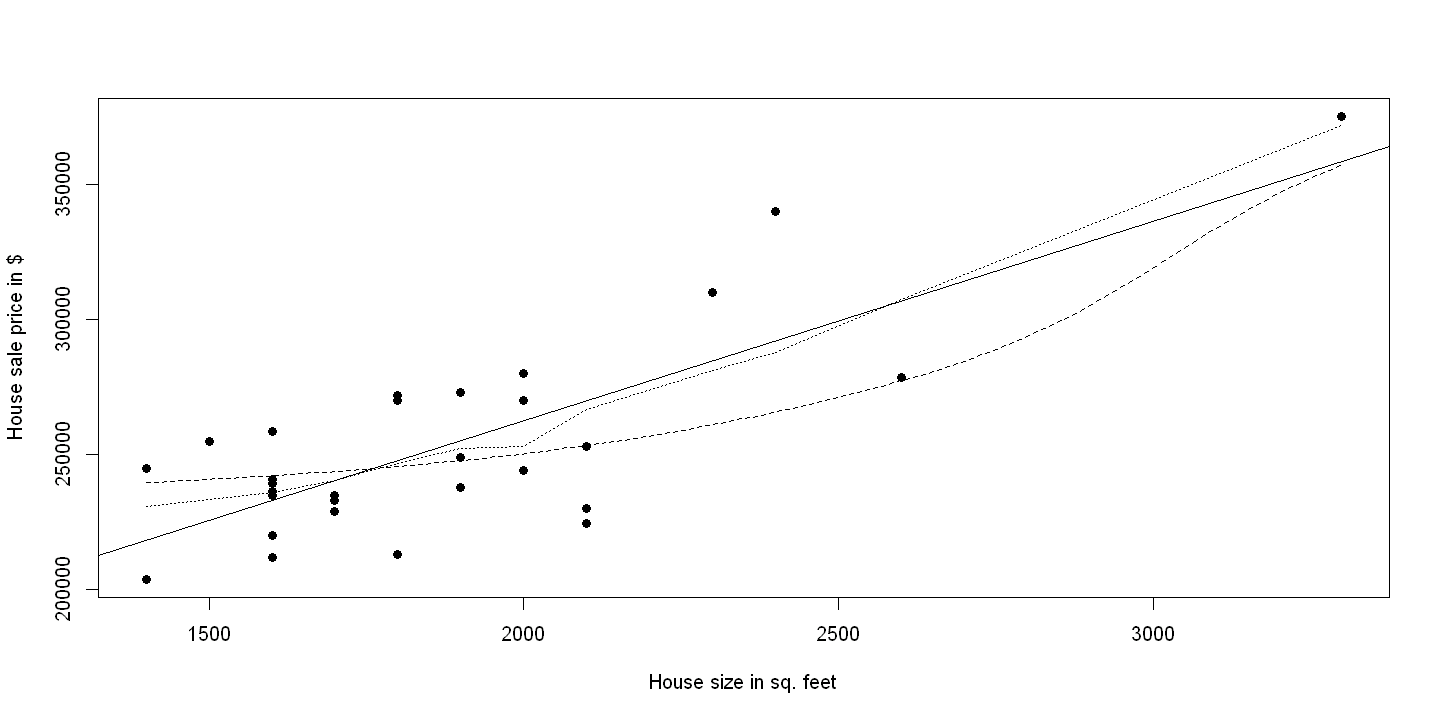

5.10. 5.12 NONPARAMETRIC REGRESSION#

summary(ols <- lm(price~size))

Call:

lm(formula = price ~ size)

Residuals:

Min 1Q Median 3Q Max

-45436 -16936 1949 17818 47932

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 115017.28 21489.36 5.352 1.18e-05 ***

size 73.77 11.17 6.601 4.41e-07 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 23550 on 27 degrees of freedom

Multiple R-squared: 0.6175, Adjusted R-squared: 0.6033

F-statistic: 43.58 on 1 and 27 DF, p-value: 4.409e-07

plot(size,price, xlab="House size in sq. feet", ylab="House sale price in $",pch=19)

abline(ols)

lines(lowess(size,price), lty=3)

lines(ksmooth(size,price, "normal", bandwidth = 1000), lty=2)

# For local linear use kernsmooth package and locpoly command

suppressPackageStartupMessages(library(KernSmooth))

plot(size,price, xlab="House size in sq. feet", ylab="House sale price in $",pch=19)

abline(ols)

lines(lowess(size,price), lty=3)

lines(locpoly(size, price, bandwidth = 2000, kernel=epan), lty=2)