9 CHAPTER 9: MODELLING VOLATILITY AND CORRELATION

9.1 Estimating the GARCH(1,1) model (Page 438)

library("foreign")

data = read.dta("Dataset/currencies.dta")

data = na.omit(data)

library("rugarch")

garch11.spec = ugarchspec(mean.model=list(armaOrder=c(0,0)),

variance.model=list(garchOrder=c(1,1),model="sGARCH"))

garch11.fit = ugarchfit(garch11.spec,data=data$rjpy)

garch11.fit

##

## *---------------------------------*

## * GARCH Model Fit *

## *---------------------------------*

##

## Conditional Variance Dynamics

## -----------------------------------

## GARCH Model : sGARCH(1,1)

## Mean Model : ARFIMA(0,0,0)

## Distribution : norm

##

## Optimal Parameters

## ------------------------------------

## Estimate Std. Error t value Pr(>|t|)

## mu 0.002546 0.006769 0.37612 0.706828

## omega 0.004489 0.001126 3.98853 0.000066

## alpha1 0.047579 0.008082 5.88696 0.000000

## beta1 0.932508 0.011884 78.46766 0.000000

##

## Robust Standard Errors:

## Estimate Std. Error t value Pr(>|t|)

## mu 0.002546 0.008090 0.31472 0.752974

## omega 0.004489 0.002849 1.57558 0.115123

## alpha1 0.047579 0.019477 2.44282 0.014573

## beta1 0.932508 0.028282 32.97212 0.000000

##

## LogLikelihood : -2460.987

##

## Information Criteria

## ------------------------------------

##

## Akaike 1.2365

## Bayes 1.2428

## Shibata 1.2365

## Hannan-Quinn 1.2387

##

## Weighted Ljung-Box Test on Standardized Residuals

## ------------------------------------

## statistic p-value

## Lag[1] 102.5 0

## Lag[2*(p+q)+(p+q)-1][2] 103.6 0

## Lag[4*(p+q)+(p+q)-1][5] 106.8 0

## d.o.f=0

## H0 : No serial correlation

##

## Weighted Ljung-Box Test on Standardized Squared Residuals

## ------------------------------------

## statistic p-value

## Lag[1] 13.72 2.119e-04

## Lag[2*(p+q)+(p+q)-1][5] 17.81 7.692e-05

## Lag[4*(p+q)+(p+q)-1][9] 21.34 9.024e-05

## d.o.f=2

##

## Weighted ARCH LM Tests

## ------------------------------------

## Statistic Shape Scale P-Value

## ARCH Lag[3] 3.514 0.500 2.000 0.06087

## ARCH Lag[5] 7.623 1.440 1.667 0.02472

## ARCH Lag[7] 9.455 2.315 1.543 0.02460

##

## Nyblom stability test

## ------------------------------------

## Joint Statistic: 0.7864

## Individual Statistics:

## mu 0.18508

## omega 0.08219

## alpha1 0.09814

## beta1 0.11643

##

## Asymptotic Critical Values (10% 5% 1%)

## Joint Statistic: 1.07 1.24 1.6

## Individual Statistic: 0.35 0.47 0.75

##

## Sign Bias Test

## ------------------------------------

## t-value prob sig

## Sign Bias 0.08355 9.334e-01

## Negative Sign Bias 4.82315 1.466e-06 ***

## Positive Sign Bias 1.65357 9.829e-02 *

## Joint Effect 29.68720 1.606e-06 ***

##

##

## Adjusted Pearson Goodness-of-Fit Test:

## ------------------------------------

## group statistic p-value(g-1)

## 1 20 847.9 1.378e-167

## 2 30 1084.9 9.530e-210

## 3 40 1291.6 1.213e-245

## 4 50 1426.0 2.061e-266

##

##

## Elapsed time : 0.2749989

9.2 GJR (‘threshold’ GARCH) (Page 442)

gjrgarch11.spec = ugarchspec(mean.model=list(armaOrder=c(0,0)),

variance.model=list(garchOrder=c(1,1),model="gjrGARCH"))

gjrgarch11.fit = ugarchfit(gjrgarch11.spec,data=data$rjpy)

gjrgarch11.fit

##

## *---------------------------------*

## * GARCH Model Fit *

## *---------------------------------*

##

## Conditional Variance Dynamics

## -----------------------------------

## GARCH Model : gjrGARCH(1,1)

## Mean Model : ARFIMA(0,0,0)

## Distribution : norm

##

## Optimal Parameters

## ------------------------------------

## Estimate Std. Error t value Pr(>|t|)

## mu -0.001369 0.006765 -0.20233 0.839658

## omega 0.003956 0.000938 4.21785 0.000025

## alpha1 0.025541 0.006127 4.16871 0.000031

## beta1 0.937628 0.010070 93.11060 0.000000

## gamma1 0.038786 0.008537 4.54342 0.000006

##

## Robust Standard Errors:

## Estimate Std. Error t value Pr(>|t|)

## mu -0.001369 0.008004 -0.17102 0.864209

## omega 0.003956 0.002096 1.88760 0.059080

## alpha1 0.025541 0.011676 2.18744 0.028710

## beta1 0.937628 0.020423 45.90967 0.000000

## gamma1 0.038786 0.017662 2.19596 0.028095

##

## LogLikelihood : -2447.737

##

## Information Criteria

## ------------------------------------

##

## Akaike 1.2304

## Bayes 1.2383

## Shibata 1.2304

## Hannan-Quinn 1.2332

##

## Weighted Ljung-Box Test on Standardized Residuals

## ------------------------------------

## statistic p-value

## Lag[1] 108.4 0

## Lag[2*(p+q)+(p+q)-1][2] 109.3 0

## Lag[4*(p+q)+(p+q)-1][5] 112.7 0

## d.o.f=0

## H0 : No serial correlation

##

## Weighted Ljung-Box Test on Standardized Squared Residuals

## ------------------------------------

## statistic p-value

## Lag[1] 10.95 0.0009360

## Lag[2*(p+q)+(p+q)-1][5] 15.34 0.0003597

## Lag[4*(p+q)+(p+q)-1][9] 19.76 0.0002321

## d.o.f=2

##

## Weighted ARCH LM Tests

## ------------------------------------

## Statistic Shape Scale P-Value

## ARCH Lag[3] 3.393 0.500 2.000 0.06547

## ARCH Lag[5] 8.179 1.440 1.667 0.01818

## ARCH Lag[7] 10.879 2.315 1.543 0.01146

##

## Nyblom stability test

## ------------------------------------

## Joint Statistic: 1.4159

## Individual Statistics:

## mu 0.14156

## omega 0.09306

## alpha1 0.10686

## beta1 0.11944

## gamma1 0.08167

##

## Asymptotic Critical Values (10% 5% 1%)

## Joint Statistic: 1.28 1.47 1.88

## Individual Statistic: 0.35 0.47 0.75

##

## Sign Bias Test

## ------------------------------------

## t-value prob sig

## Sign Bias 1.393 1.638e-01

## Negative Sign Bias 3.204 1.364e-03 ***

## Positive Sign Bias 2.727 6.429e-03 ***

## Joint Effect 23.302 3.494e-05 ***

##

##

## Adjusted Pearson Goodness-of-Fit Test:

## ------------------------------------

## group statistic p-value(g-1)

## 1 20 818.6 2.444e-161

## 2 30 998.8 1.574e-191

## 3 40 1138.9 1.757e-213

## 4 50 1275.1 8.706e-235

##

##

## Elapsed time : 0.4268448

9.3 EGARCH (Page 443)

egarch11.spec = ugarchspec(mean.model=list(armaOrder=c(0,0)),

variance.model=list(garchOrder=c(1,1),model="eGARCH"))

egarch11.fit = ugarchfit(egarch11.spec,data=data$rjpy)

egarch11.fit

##

## *---------------------------------*

## * GARCH Model Fit *

## *---------------------------------*

##

## Conditional Variance Dynamics

## -----------------------------------

## GARCH Model : eGARCH(1,1)

## Mean Model : ARFIMA(0,0,0)

## Distribution : norm

##

## Optimal Parameters

## ------------------------------------

## Estimate Std. Error t value Pr(>|t|)

## mu -0.001276 0.002104 -0.60618 0.544393

## omega -0.022104 0.013013 -1.69861 0.089393

## alpha1 -0.037615 0.011148 -3.37416 0.000740

## beta1 0.979362 0.009578 102.24797 0.000000

## gamma1 0.108134 0.025814 4.18895 0.000028

##

## Robust Standard Errors:

## Estimate Std. Error t value Pr(>|t|)

## mu -0.001276 0.000962 -1.32584 0.18489

## omega -0.022104 0.059750 -0.36994 0.71142

## alpha1 -0.037615 0.050061 -0.75138 0.45243

## beta1 0.979362 0.044902 21.81124 0.00000

## gamma1 0.108134 0.114671 0.94300 0.34568

##

## LogLikelihood : -2443.073

##

## Information Criteria

## ------------------------------------

##

## Akaike 1.2280

## Bayes 1.2359

## Shibata 1.2280

## Hannan-Quinn 1.2308

##

## Weighted Ljung-Box Test on Standardized Residuals

## ------------------------------------

## statistic p-value

## Lag[1] 111.3 0

## Lag[2*(p+q)+(p+q)-1][2] 112.3 0

## Lag[4*(p+q)+(p+q)-1][5] 115.8 0

## d.o.f=0

## H0 : No serial correlation

##

## Weighted Ljung-Box Test on Standardized Squared Residuals

## ------------------------------------

## statistic p-value

## Lag[1] 12.44 0.0004207

## Lag[2*(p+q)+(p+q)-1][5] 16.28 0.0002013

## Lag[4*(p+q)+(p+q)-1][9] 20.74 0.0001291

## d.o.f=2

##

## Weighted ARCH LM Tests

## ------------------------------------

## Statistic Shape Scale P-Value

## ARCH Lag[3] 2.957 0.500 2.000 0.08552

## ARCH Lag[5] 7.236 1.440 1.667 0.03060

## ARCH Lag[7] 10.357 2.315 1.543 0.01520

##

## Nyblom stability test

## ------------------------------------

## Joint Statistic: 1.1567

## Individual Statistics:

## mu 0.05683

## omega 0.09884

## alpha1 0.23824

## beta1 0.08921

## gamma1 0.13344

##

## Asymptotic Critical Values (10% 5% 1%)

## Joint Statistic: 1.28 1.47 1.88

## Individual Statistic: 0.35 0.47 0.75

##

## Sign Bias Test

## ------------------------------------

## t-value prob sig

## Sign Bias 1.101 2.712e-01

## Negative Sign Bias 3.425 6.221e-04 ***

## Positive Sign Bias 2.649 8.104e-03 ***

## Joint Effect 23.431 3.283e-05 ***

##

##

## Adjusted Pearson Goodness-of-Fit Test:

## ------------------------------------

## group statistic p-value(g-1)

## 1 20 820.0 1.211e-161

## 2 30 989.4 1.483e-189

## 3 40 1132.0 4.906e-212

## 4 50 1289.9 6.899e-238

##

##

## Elapsed time : 0.3589249

garch11.ni = newsimpact(garch11.fit)

gjrgarch11.ni = newsimpact(gjrgarch11.fit)

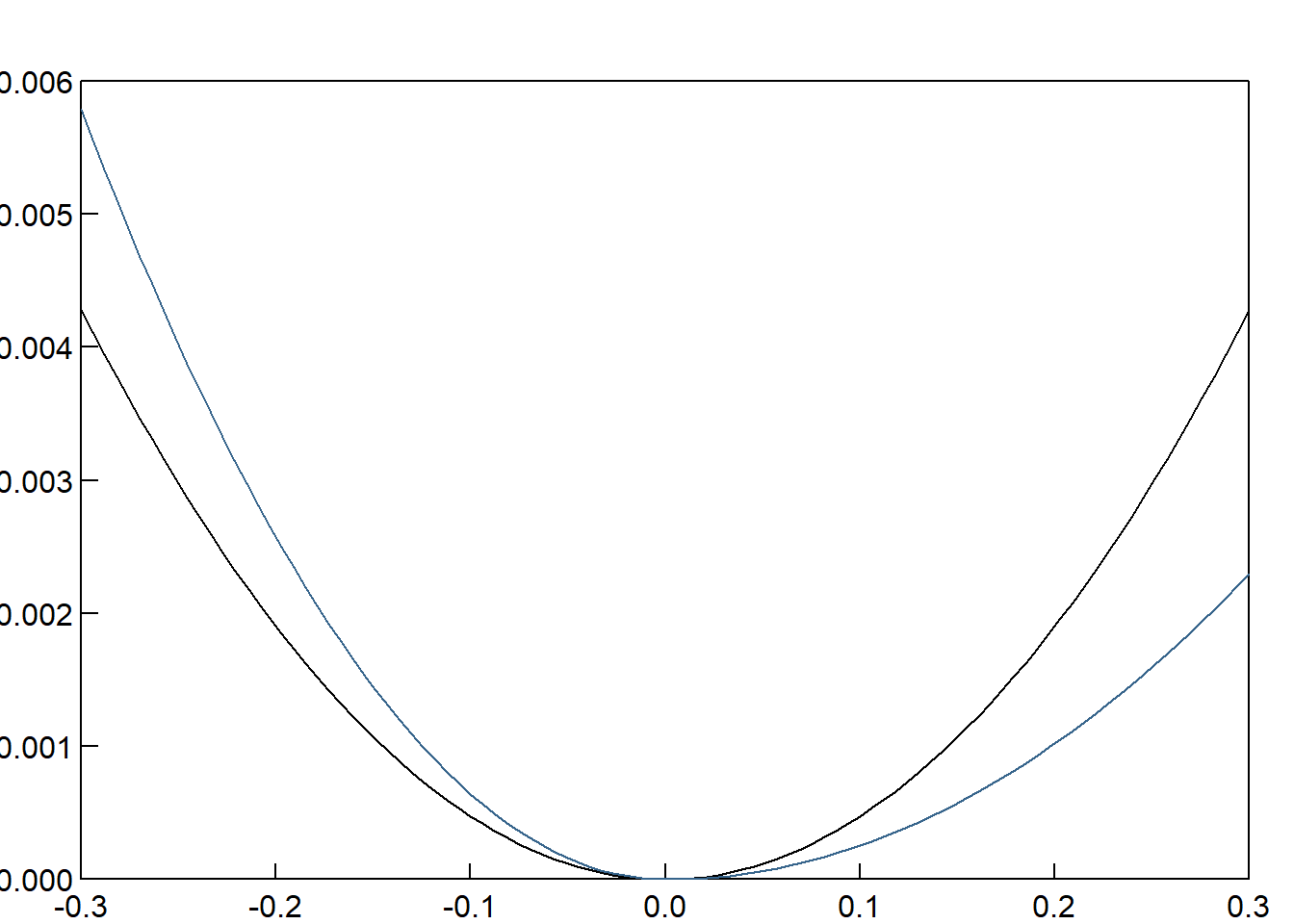

9.4 FIGURE 9.3. (Page 445)

News impact curves for S&P500 returns coefficients implied from GARCH and GJR model estimates

par(mfcol = c(1,1), oma = c(0,0,1,0) + 0.2, mar = c(0,1,0,0) + 1, mgp = c(0, 0.2, 0))

plot(garch11.ni$zx,garch11.ni$zy-min(abs(garch11.ni$zy)),type="l",las=1,xlab="",ylab="",main="",xaxs="i",yaxs="i",tck=.02,ylim=c(0,0.006))

lines(gjrgarch11.ni$zx,gjrgarch11.ni$zy-min(abs(gjrgarch11.ni$zy)),col="steelblue4")

9.5 GARCH-in-mean (Page 446)

garchm11.spec = ugarchspec(mean.model=list(armaOrder=c(0,0),archm=TRUE,archpow=1),

variance.model=list(garchOrder=c(1,1),model="sGARCH"))

garchm11.fit = ugarchfit(garchm11.spec,data=data$rjpy)

garchm11.fit

##

## *---------------------------------*

## * GARCH Model Fit *

## *---------------------------------*

##

## Conditional Variance Dynamics

## -----------------------------------

## GARCH Model : sGARCH(1,1)

## Mean Model : ARFIMA(0,0,0)

## Distribution : norm

##

## Optimal Parameters

## ------------------------------------

## Estimate Std. Error t value Pr(>|t|)

## mu 0.024452 0.034364 0.71155 0.476743

## archm -0.051739 0.079680 -0.64934 0.516121

## omega 0.004409 0.001117 3.94612 0.000079

## alpha1 0.047424 0.008052 5.88950 0.000000

## beta1 0.933047 0.011815 78.97247 0.000000

##

## Robust Standard Errors:

## Estimate Std. Error t value Pr(>|t|)

## mu 0.024452 0.042288 0.57822 0.563115

## archm -0.051739 0.095217 -0.54338 0.586870

## omega 0.004409 0.002816 1.56598 0.117352

## alpha1 0.047424 0.019557 2.42491 0.015312

## beta1 0.933047 0.028292 32.97891 0.000000

##

## LogLikelihood : -2460.776

##

## Information Criteria

## ------------------------------------

##

## Akaike 1.2369

## Bayes 1.2448

## Shibata 1.2369

## Hannan-Quinn 1.2397

##

## Weighted Ljung-Box Test on Standardized Residuals

## ------------------------------------

## statistic p-value

## Lag[1] 102.7 0

## Lag[2*(p+q)+(p+q)-1][2] 103.8 0

## Lag[4*(p+q)+(p+q)-1][5] 107.0 0

## d.o.f=0

## H0 : No serial correlation

##

## Weighted Ljung-Box Test on Standardized Squared Residuals

## ------------------------------------

## statistic p-value

## Lag[1] 14.02 1.812e-04

## Lag[2*(p+q)+(p+q)-1][5] 18.07 6.541e-05

## Lag[4*(p+q)+(p+q)-1][9] 21.60 7.757e-05

## d.o.f=2

##

## Weighted ARCH LM Tests

## ------------------------------------

## Statistic Shape Scale P-Value

## ARCH Lag[3] 3.478 0.500 2.000 0.06218

## ARCH Lag[5] 7.552 1.440 1.667 0.02571

## ARCH Lag[7] 9.400 2.315 1.543 0.02532

##

## Nyblom stability test

## ------------------------------------

## Joint Statistic: 0.7806

## Individual Statistics:

## mu 0.15261

## archm 0.15783

## omega 0.08669

## alpha1 0.09929

## beta1 0.12005

##

## Asymptotic Critical Values (10% 5% 1%)

## Joint Statistic: 1.28 1.47 1.88

## Individual Statistic: 0.35 0.47 0.75

##

## Sign Bias Test

## ------------------------------------

## t-value prob sig

## Sign Bias 0.4557 6.486e-01

## Negative Sign Bias 4.6212 3.937e-06 ***

## Positive Sign Bias 1.8567 6.343e-02 *

## Joint Effect 30.2116 1.246e-06 ***

##

##

## Adjusted Pearson Goodness-of-Fit Test:

## ------------------------------------

## group statistic p-value(g-1)

## 1 20 778.1 9.575e-153

## 2 30 969.4 2.481e-185

## 3 40 1156.7 3.103e-217

## 4 50 1252.4 4.850e-230

##

##

## Elapsed time : 0.678983

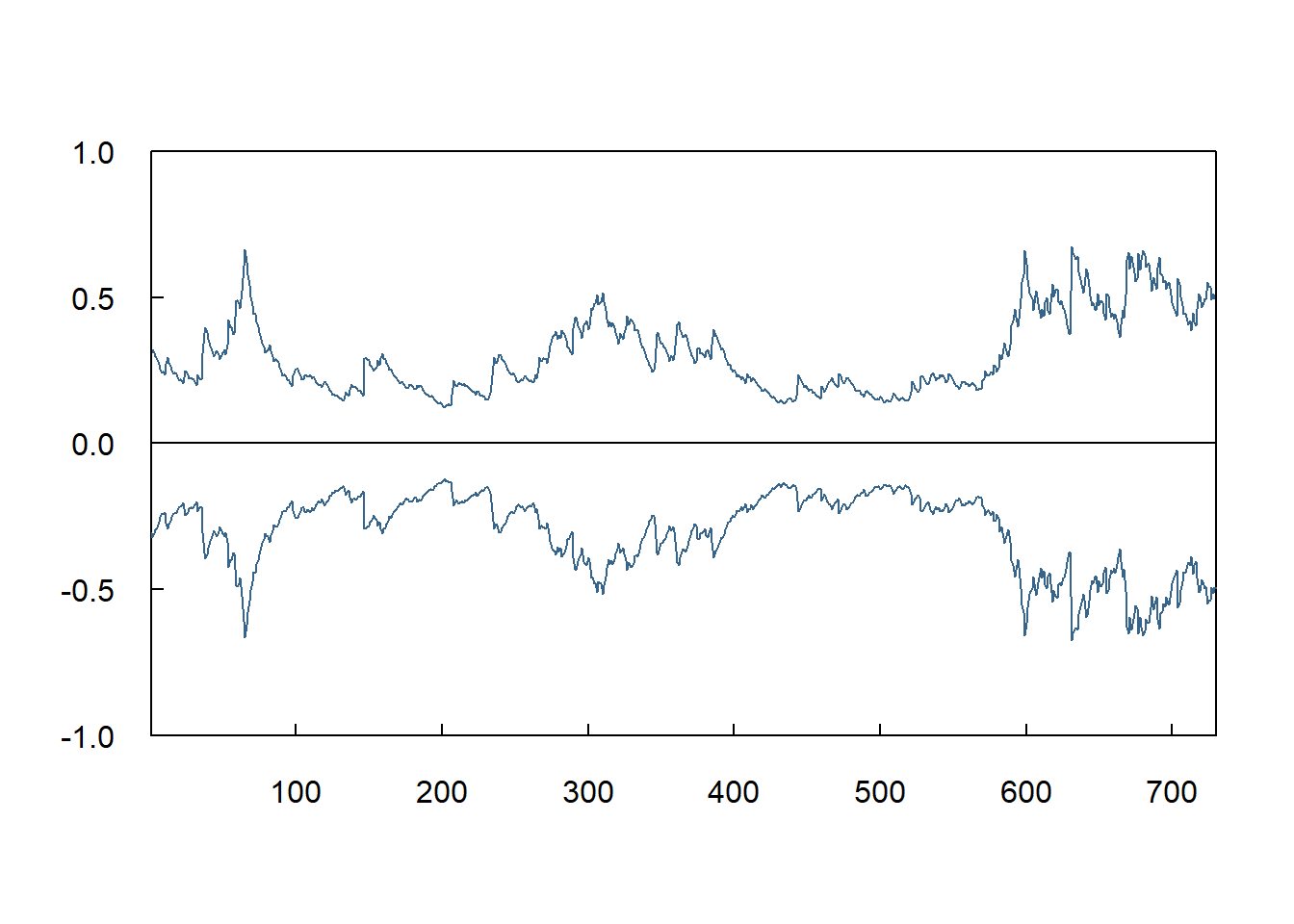

9.6 Screenshot 9.4 Dynamic forecasts of the conditional variance (Page 450)

egarch11.fore = ugarchforecast(egarch11.fit,n.ahead=730)

lower =-1.65*egarch11.fore@forecast$sigmaFor

upper = 1.65*egarch11.fore@forecast$sigmaFor

plot(lower,type="l",las=1,xlab="",ylab="",main="",xaxs="i",yaxs="i",tck=.02,ylim=c(-1,1),col="steelblue4")

lines(upper,col="steelblue4")

abline(h=0)

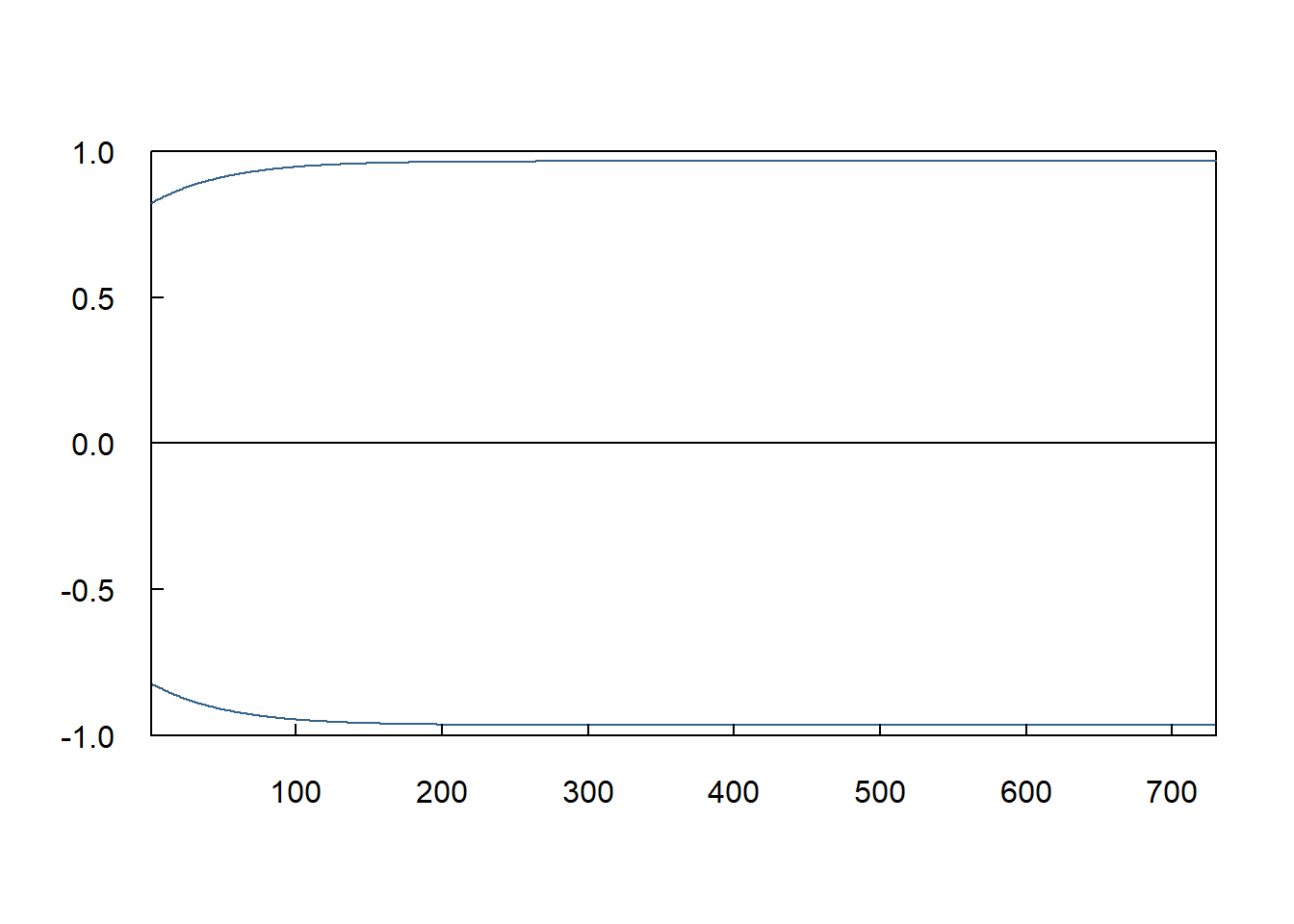

9.7 Screenshot 9.5 Static forecasts of the conditional variance (Page 451)

library(xts)

# Ensure 'data' has a Date column

rjpy_xts <- xts(data$rjpy, order.by = data$Date)

space <- 730

sigma.fore <- numeric(space)

for (i in 1:space) {

dynamic.egarch.fit <- ugarchfit(egarch11.spec, rjpy_xts[1:(nrow(rjpy_xts)-space+i)])

sigma.fore[i] <- ugarchforecast(dynamic.egarch.fit, n.ahead = 1)@forecast$sigmaFor

if (i %% 50 == 0) {

print(i / space * 100)

}

}

## [1] 6.849315

## [1] 13.69863

## [1] 20.54795

## [1] 27.39726

## [1] 34.24658

## [1] 41.09589

## [1] 47.94521

## [1] 54.79452

## [1] 61.64384

## [1] 68.49315

## [1] 75.34247

## [1] 82.19178

## [1] 89.0411

## [1] 95.89041

plot(2 * sigma.fore^2, type = "l", las = 1, xlab = "", ylab = "",

main = "", xaxs = "i", yaxs = "i", tck = .02, col = "steelblue4", ylim = c(-1, 1))

lines(-2 * sigma.fore^2, col = "steelblue4")

abline(h = 0)