Testing for heteroscedasticity (Page 187)

# First regression

lm1 <- lm(ermsoft ~ ersandp + dprod + dcredit + dinflation + dmoney + dspread + rterm, data = data)

# Add residuals squared to data frame

data$Resid = lm1$residuals

data$Resid_sq <- resid(lm1)^2

# Second regression using squared predictors

lm2 <- lm(Resid_sq ~ I(ersandp^2) + I(dprod^2) + I(dcredit^2) +

I(dinflation^2) + I(dmoney^2) + I(dspread^2) + I(rterm^2),

data = data)

# Display summary

summary(lm2)

##

## Call:

## lm(formula = Resid_sq ~ I(ersandp^2) + I(dprod^2) + I(dcredit^2) +

## I(dinflation^2) + I(dmoney^2) + I(dspread^2) + I(rterm^2),

## data = data)

##

## Residuals:

## Min 1Q Median 3Q Max

## -188.9 -159.1 -129.7 -68.2 4305.1

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 1.936e+02 4.283e+01 4.519 8.79e-06 ***

## I(ersandp^2) -1.627e-01 6.984e-01 -0.233 0.816

## I(dprod^2) -1.134e+01 3.119e+01 -0.363 0.717

## I(dcredit^2) -1.013e-08 3.983e-08 -0.254 0.799

## I(dinflation^2) -6.578e+01 1.500e+02 -0.438 0.661

## I(dmoney^2) -1.228e-02 2.722e-02 -0.451 0.652

## I(dspread^2) -2.023e+00 6.384e+02 -0.003 0.997

## I(rterm^2) -1.963e+02 2.944e+02 -0.667 0.505

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 558.5 on 316 degrees of freedom

## Multiple R-squared: 0.006295, Adjusted R-squared: -0.01572

## F-statistic: 0.286 on 7 and 316 DF, p-value: 0.9592

The Breusch–Godfrey test or Autocorrelation (pp208)

p <- 10

Reslag <- embed(data$Resid, p + 1)[, -1]

lm3 <- lm(Resid ~ ersandp + dprod + dcredit + dinflation + dmoney + dspread + rterm + Reslag,

data = data[-(1:p), ])

summary(lm3)

##

## Call:

## lm(formula = Resid ~ ersandp + dprod + dcredit + dinflation +

## dmoney + dspread + rterm + Reslag, data = data[-(1:p), ])

##

## Residuals:

## Min 1Q Median 3Q Max

## -62.962 -3.806 1.031 6.066 27.327

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -2.574e-01 8.898e-01 -0.289 0.77257

## ersandp -4.231e-02 1.580e-01 -0.268 0.78908

## dprod 6.400e-02 1.296e+00 0.049 0.96064

## dcredit 1.752e-06 7.485e-05 0.023 0.98134

## dinflation -4.591e-01 2.181e+00 -0.211 0.83340

## dmoney -4.422e-03 3.447e-02 -0.128 0.89800

## dspread 1.530e+00 6.851e+00 0.223 0.82348

## rterm 7.962e-01 2.523e+00 0.316 0.75257

## Reslag1 -1.647e-01 5.847e-02 -2.817 0.00517 **

## Reslag2 -8.471e-02 5.805e-02 -1.459 0.14552

## Reslag3 -4.682e-02 5.797e-02 -0.808 0.41994

## Reslag4 -1.387e-01 5.725e-02 -2.423 0.01601 *

## Reslag5 -1.255e-01 5.654e-02 -2.220 0.02720 *

## Reslag6 -1.138e-01 5.645e-02 -2.016 0.04466 *

## Reslag7 -7.230e-02 5.675e-02 -1.274 0.20363

## Reslag8 -1.123e-01 5.668e-02 -1.982 0.04842 *

## Reslag9 -1.632e-01 5.678e-02 -2.874 0.00435 **

## Reslag10 -6.171e-02 5.690e-02 -1.085 0.27895

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 12.26 on 296 degrees of freedom

## Multiple R-squared: 0.07896, Adjusted R-squared: 0.02606

## F-statistic: 1.493 on 17 and 296 DF, p-value: 0.09573

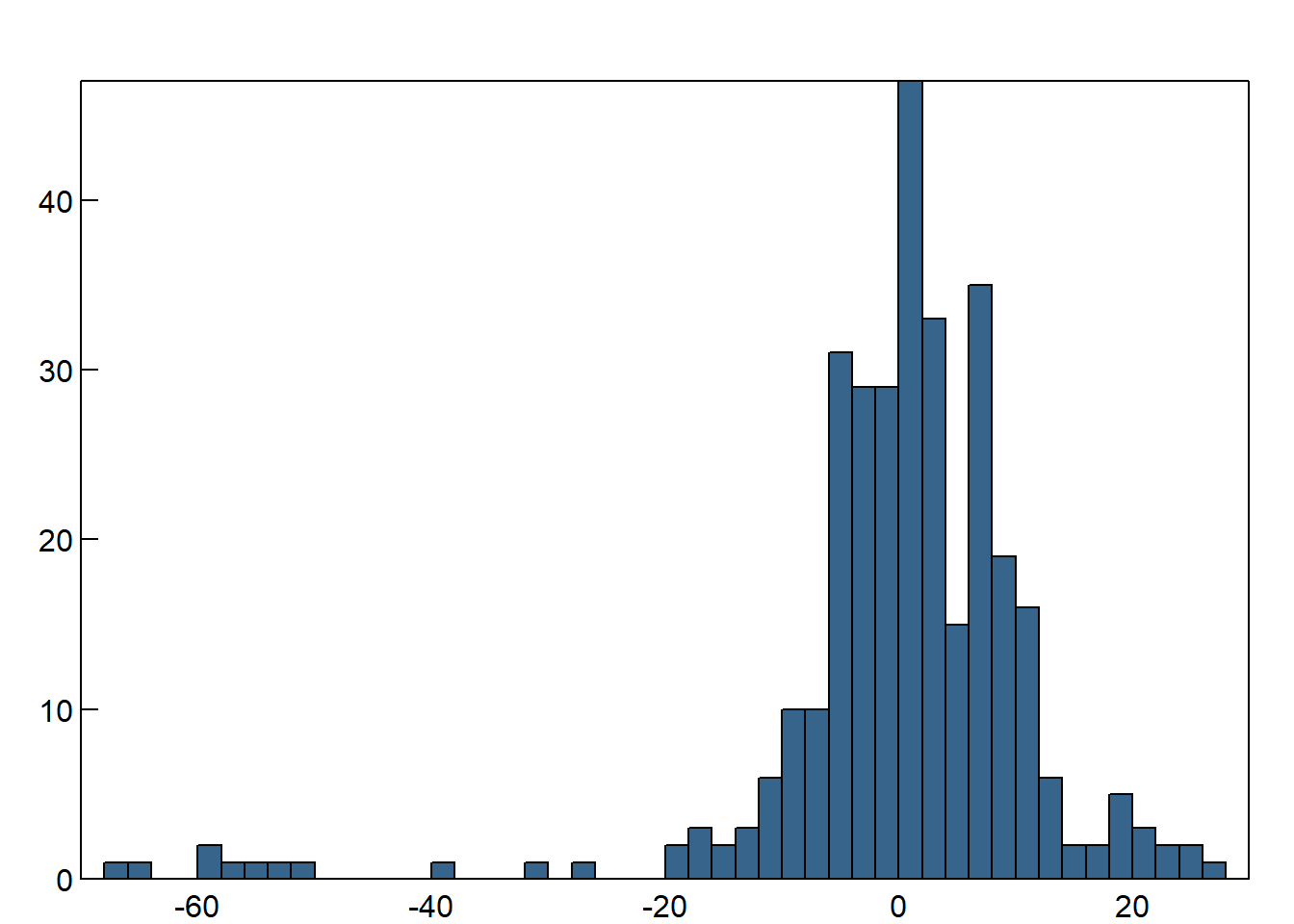

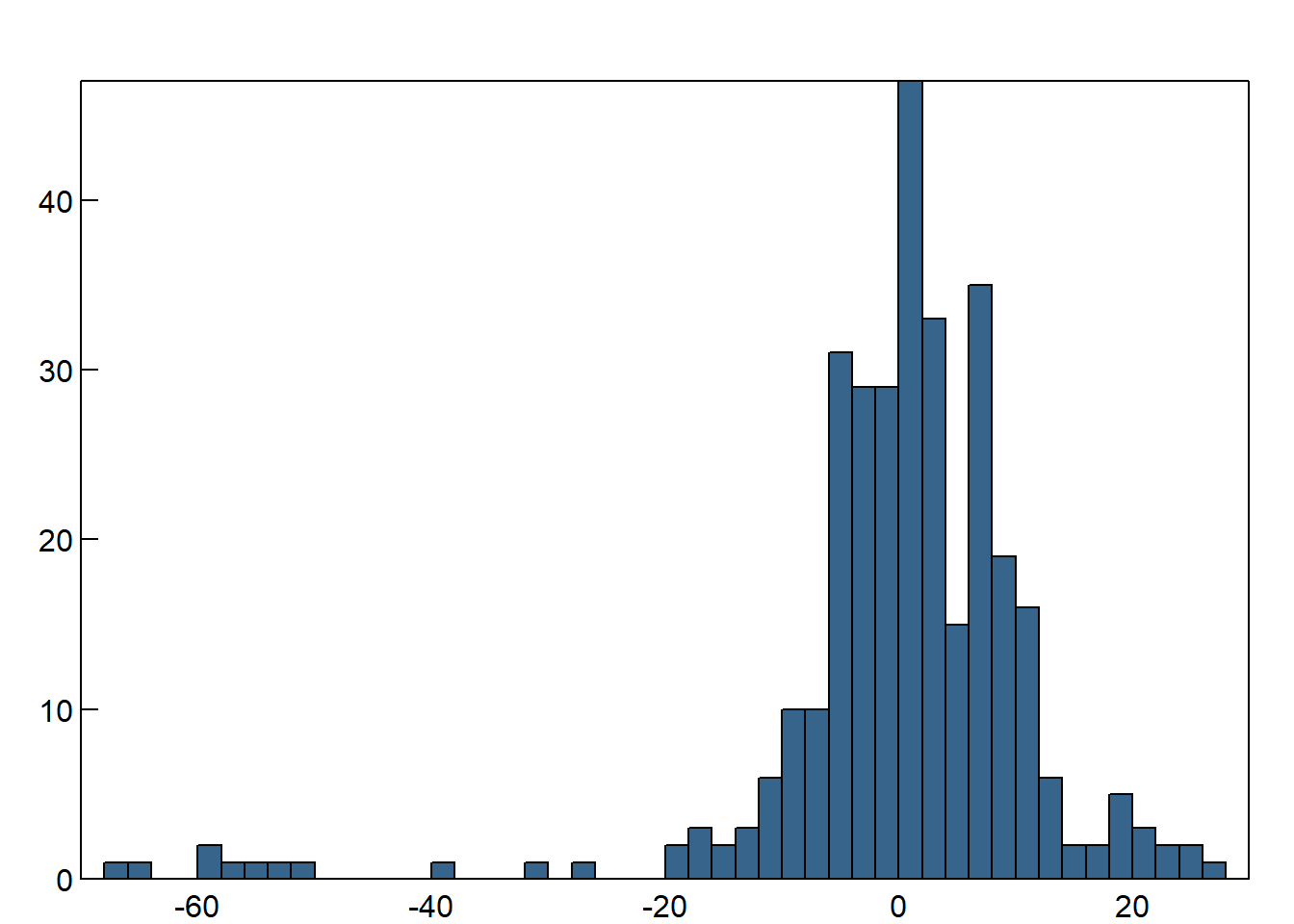

Screenshot 5.2 Non-normality test results (Page 211)

par(mfcol = c(1, 1), oma = c(0.2, 0.2, 1.2, 0.2), mar = c(1, 2, 1, 1), mgp = c(0, 0.2, 0))

hist(data$Resid, freq = TRUE, breaks = 40, las = 1, col = "steelblue4",

xlab = "", ylab = "", main = "", xaxs = "i", yaxs = "i", xlim = c(-70, 30), tck = 0.02)

box()

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -66.985 -3.643 1.105 0.000 6.661 26.587

## [1] 12.5209

library(moments)

skewness(data$Resid)

## [1] -2.535283

## [1] 13.53493

##

## Jarque-Bera Normality Test

##

## data: data$Resid

## JB = 1845.4, p-value < 2.2e-16

## alternative hypothesis: greater

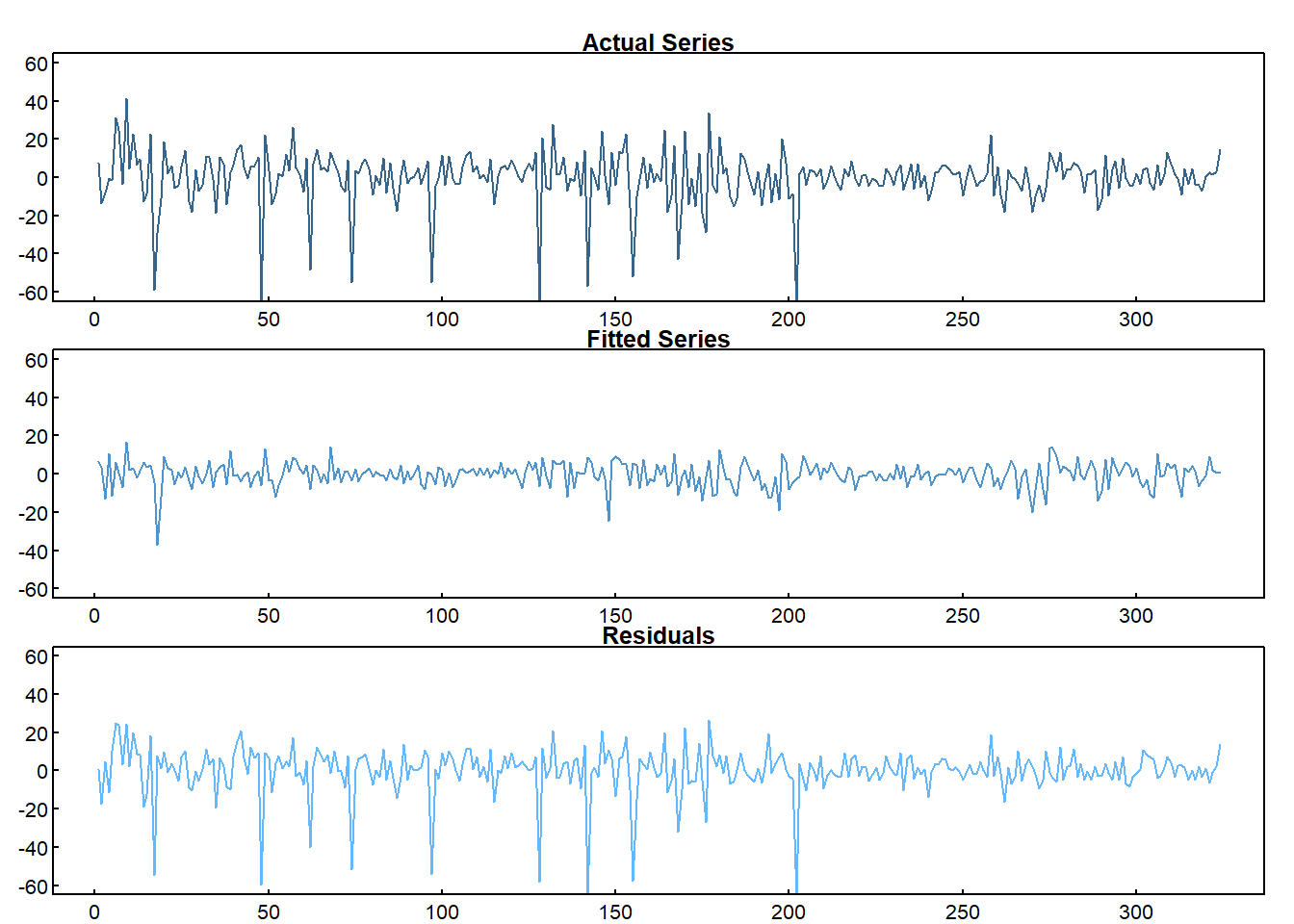

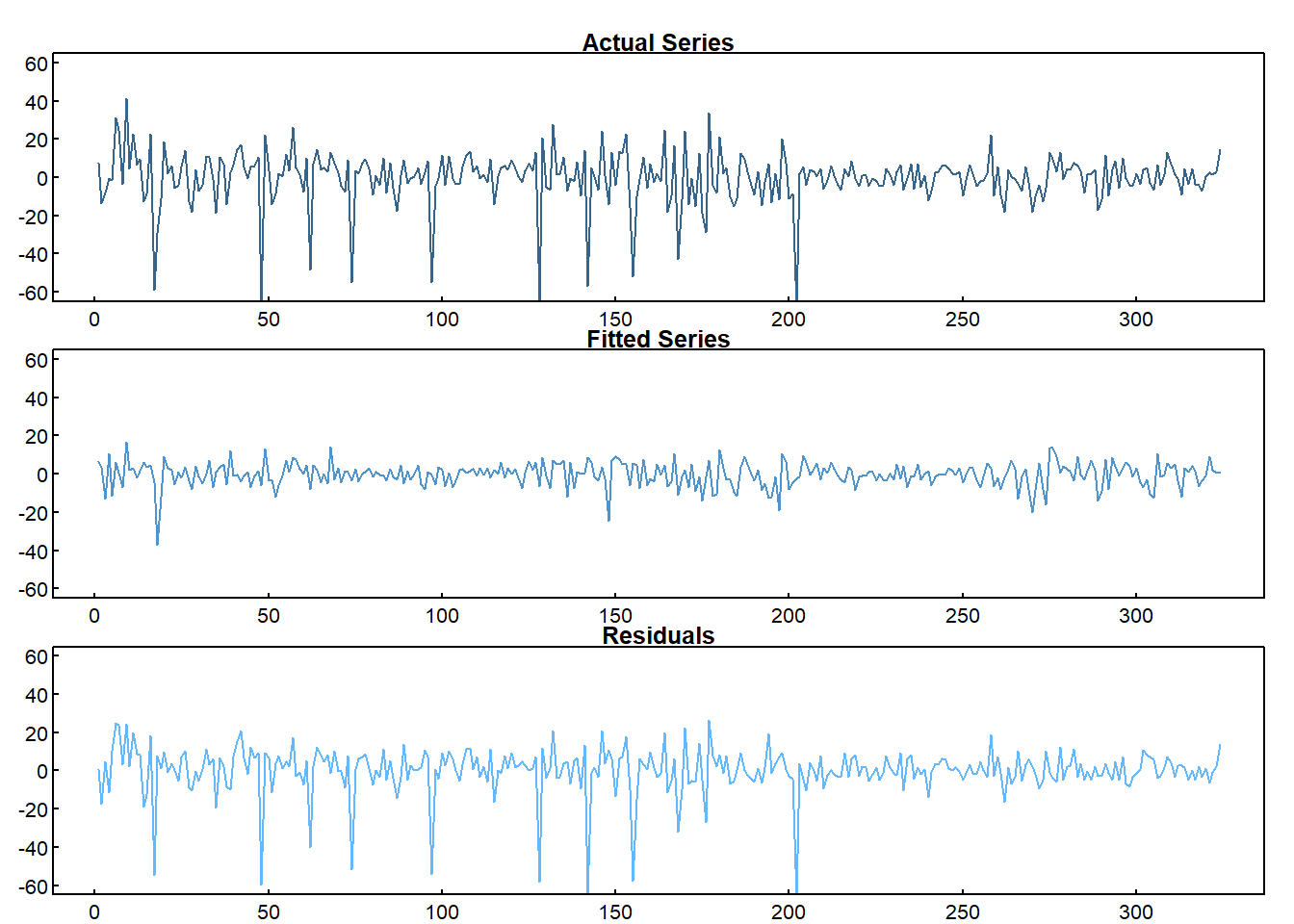

Screenshot 5.3 Regression residuals, actual values and fitted series (Page 215)

par(mfcol = c(3, 1), oma = c(0.2, 0.2, 1.2, 0.2), mar = c(1, 2, 1, 1), mgp = c(0, 0.2, 0))

plot(data$ermsoft, type = "l", las = 1, col = "steelblue4", main = "Actual Series",

xlab = "", ylab = "", ylim = c(-60, 60), tck = 0.02)

plot(fitted(lm1), type = "l", las = 1, col = "steelblue3", main = "Fitted Series",

xlab = "", ylab = "", ylim = c(-60, 60), tck = 0.02)

plot(data$Resid, type = "l", las = 1, col = "steelblue1", main = "Residuals",

xlab = "", ylab = "", ylim = c(-60, 60), tck = 0.02)

Regression with Dummy Variables (Page 216)

lm4 <- lm(ermsoft ~ ersandp + dprod + dcredit + dinflation + dmoney + dspread + rterm + FEB98DUM + FEB03DUM,

data = data)

summary(lm4)

##

## Call:

## lm(formula = ermsoft ~ ersandp + dprod + dcredit + dinflation +

## dmoney + dspread + rterm + FEB98DUM + FEB03DUM, data = data)

##

## Residuals:

## Min 1Q Median 3Q Max

## -59.475 -4.229 0.650 6.434 25.494

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 2.941e-01 8.262e-01 0.356 0.7221

## ersandp 1.401e+00 1.432e-01 9.787 < 2e-16 ***

## dprod -1.334e+00 1.207e+00 -1.105 0.2699

## dcredit -3.948e-05 6.962e-05 -0.567 0.5711

## dinflation 3.518e+00 1.975e+00 1.781 0.0759 .

## dmoney -2.196e-02 3.210e-02 -0.684 0.4944

## dspread 5.351e+00 6.302e+00 0.849 0.3965

## rterm 4.650e+00 2.291e+00 2.029 0.0433 *

## FEB98DUM -6.648e+01 1.160e+01 -5.729 2.37e-08 ***

## FEB03DUM -6.761e+01 1.158e+01 -5.838 1.32e-08 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 11.53 on 314 degrees of freedom

## Multiple R-squared: 0.3461, Adjusted R-squared: 0.3273

## F-statistic: 18.46 on 9 and 314 DF, p-value: < 2.2e-16

Correlation Matrix (Page 220)

df <- data[, c("dprod", "dcredit", "dinflation", "dmoney", "dspread", "rterm")]

cor(df)

## dprod dcredit dinflation dmoney dspread rterm

## dprod 1.000000000 0.141066050 -0.12426873 -0.13006021 -0.055572949 -0.002375089

## dcredit 0.141066050 1.000000000 0.04516382 -0.01172447 0.015264080 0.009675069

## dinflation -0.124268730 0.045163824 1.00000000 -0.09797243 -0.224837965 -0.054192265

## dmoney -0.130060210 -0.011724472 -0.09797243 1.00000000 0.213575550 -0.086217900

## dspread -0.055572949 0.015264080 -0.22483797 0.21357555 1.000000000 0.001570935

## rterm -0.002375089 0.009675069 -0.05419227 -0.08621790 0.001570935 1.000000000

RESET Test (Page 224)

lm5 <- lm(ermsoft ~ ersandp + dprod + dcredit + dinflation + dmoney + dspread + rterm + FEB98DUM + FEB03DUM + I(fitted(lm4)^2),

data = data)

summary(lm5)

##

## Call:

## lm(formula = ermsoft ~ ersandp + dprod + dcredit + dinflation +

## dmoney + dspread + rterm + FEB98DUM + FEB03DUM + I(fitted(lm4)^2),

## data = data)

##

## Residuals:

## Min 1Q Median 3Q Max

## -58.928 -4.298 0.943 6.322 24.747

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -2.838e-01 8.934e-01 -0.318 0.750997

## ersandp 1.500e+00 1.545e-01 9.709 < 2e-16 ***

## dprod -1.447e+00 1.205e+00 -1.201 0.230702

## dcredit -3.078e-05 6.962e-05 -0.442 0.658686

## dinflation 3.586e+00 1.970e+00 1.820 0.069663 .

## dmoney -2.251e-02 3.201e-02 -0.703 0.482480

## dspread 4.487e+00 6.305e+00 0.712 0.477196

## rterm 4.518e+00 2.286e+00 1.976 0.049030 *

## FEB98DUM -1.046e+02 2.557e+01 -4.091 5.46e-05 ***

## FEB03DUM -1.236e+02 3.544e+01 -3.489 0.000555 ***

## I(fitted(lm4)^2) 1.172e-02 7.007e-03 1.672 0.095478 .

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 11.5 on 313 degrees of freedom

## Multiple R-squared: 0.3518, Adjusted R-squared: 0.3311

## F-statistic: 16.99 on 10 and 313 DF, p-value: < 2.2e-16

library(lmtest)

reset(lm4, power = 2)

##

## RESET test

##

## data: lm4

## RESET = 2.7964, df1 = 1, df2 = 313, p-value = 0.09548