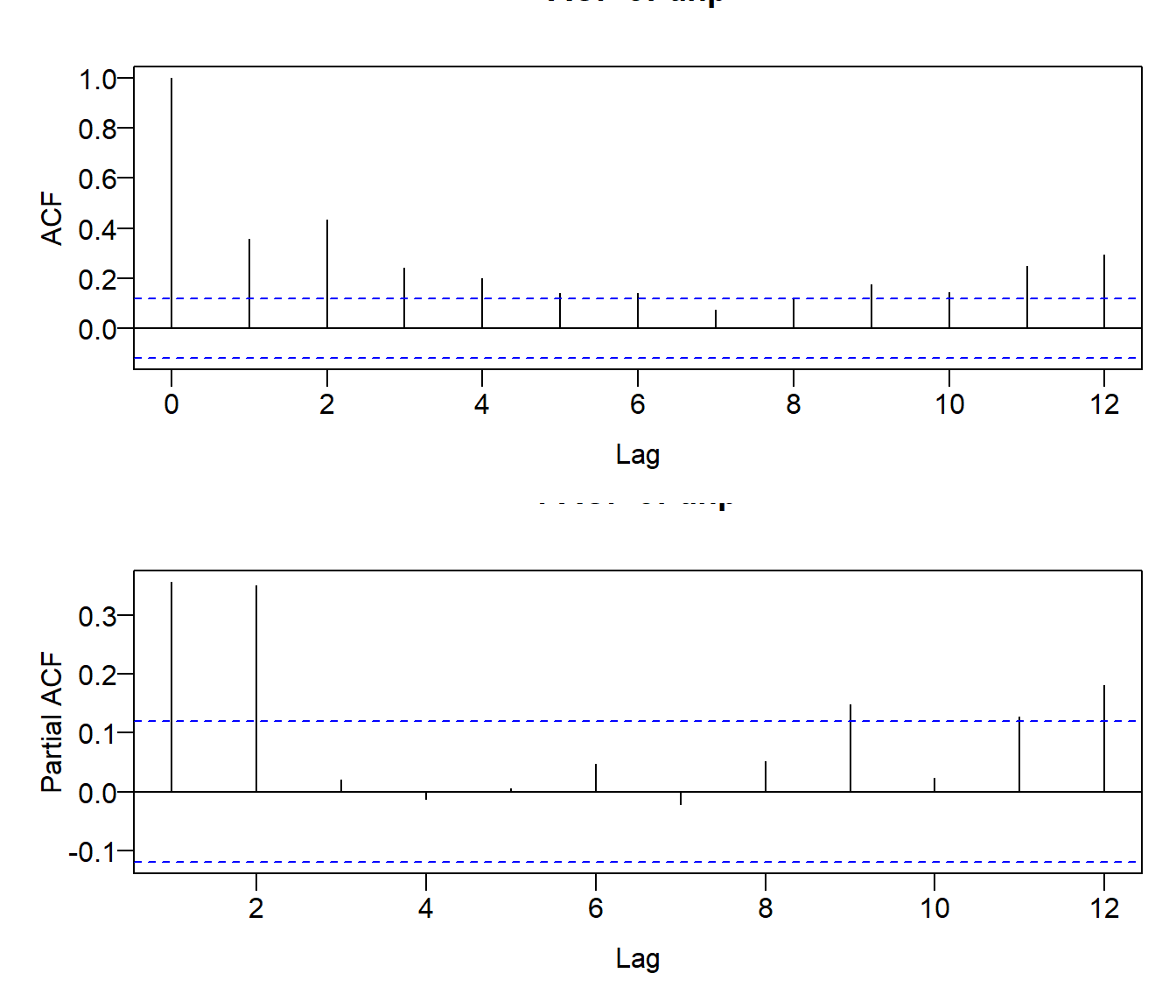

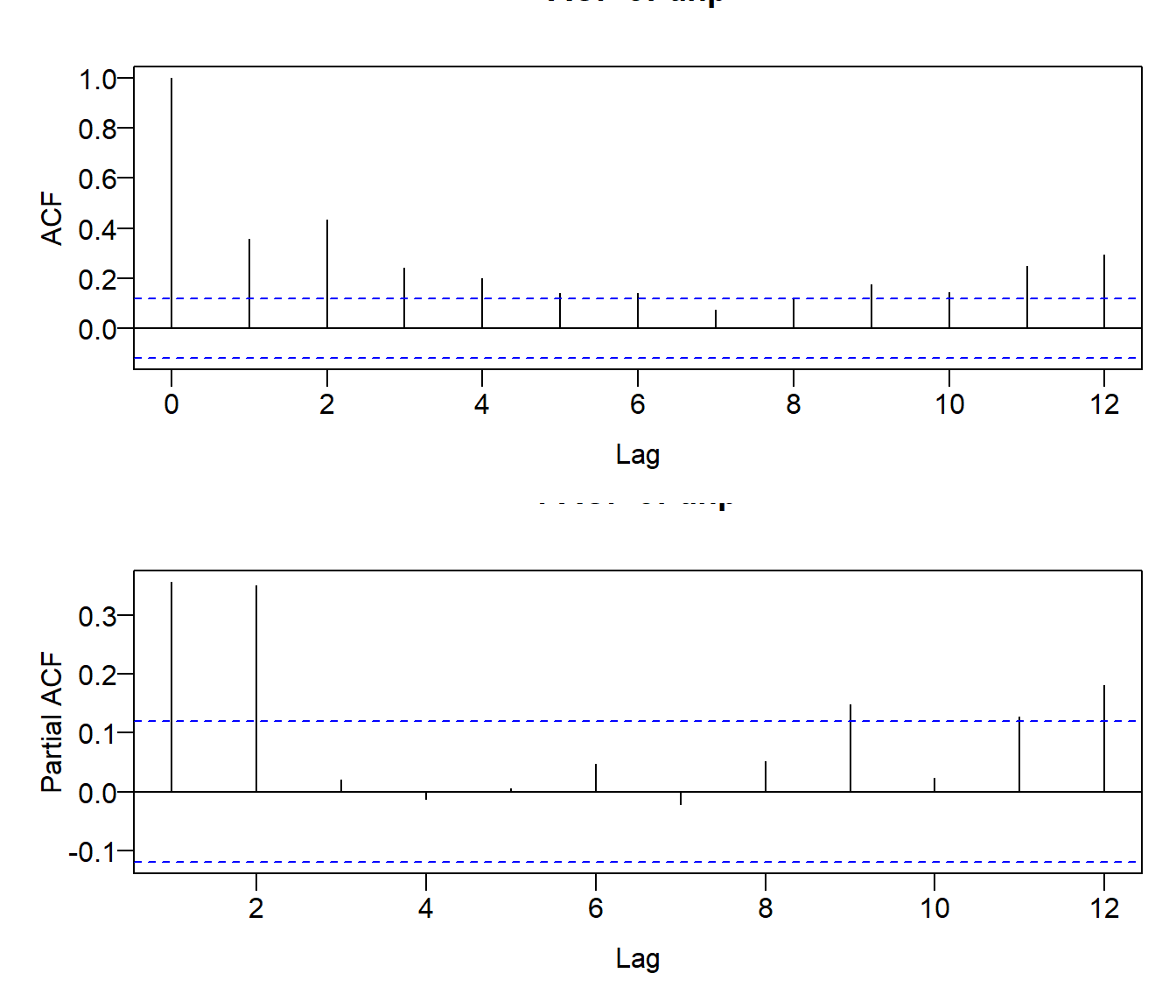

Screenshot 6.1 Estimating the correlogram (Page 277)

data_ukhp <- read.dta("Dataset/ukhp.dta")

data_ukhp <- na.omit(data_ukhp)

par(mfcol = c(2, 1), mar = c(4, 4, 2, 1), mgp = c(2, 0.5, 0))

acf(data_ukhp$dhp, lag = 12, las = 1, main = "ACF of dhp")

pacf(data_ukhp$dhp, lag = 12, las = 1, main = "PACF of dhp")

ARIMA (Page 279)

library(forecast)

summary(model <- Arima(data_ukhp$dhp, order = c(1, 0, 1), include.mean = TRUE))

## Series: data_ukhp$dhp

## ARIMA(1,0,1) with non-zero mean

##

## Coefficients:

## ar1 ma1 mean

## 0.8364 -0.5608 0.4441

## s.e. 0.0622 0.0941 0.1727

##

## sigma^2 = 1.154: log likelihood = -398.14

## AIC=804.29 AICc=804.44 BIC=818.65

##

## Training set error measures:

## ME RMSE MAE MPE MAPE MASE ACF1

## Training set 0.0001903891 1.068324 0.8169962 113.6997 205.435 0.8054493 -0.06479526

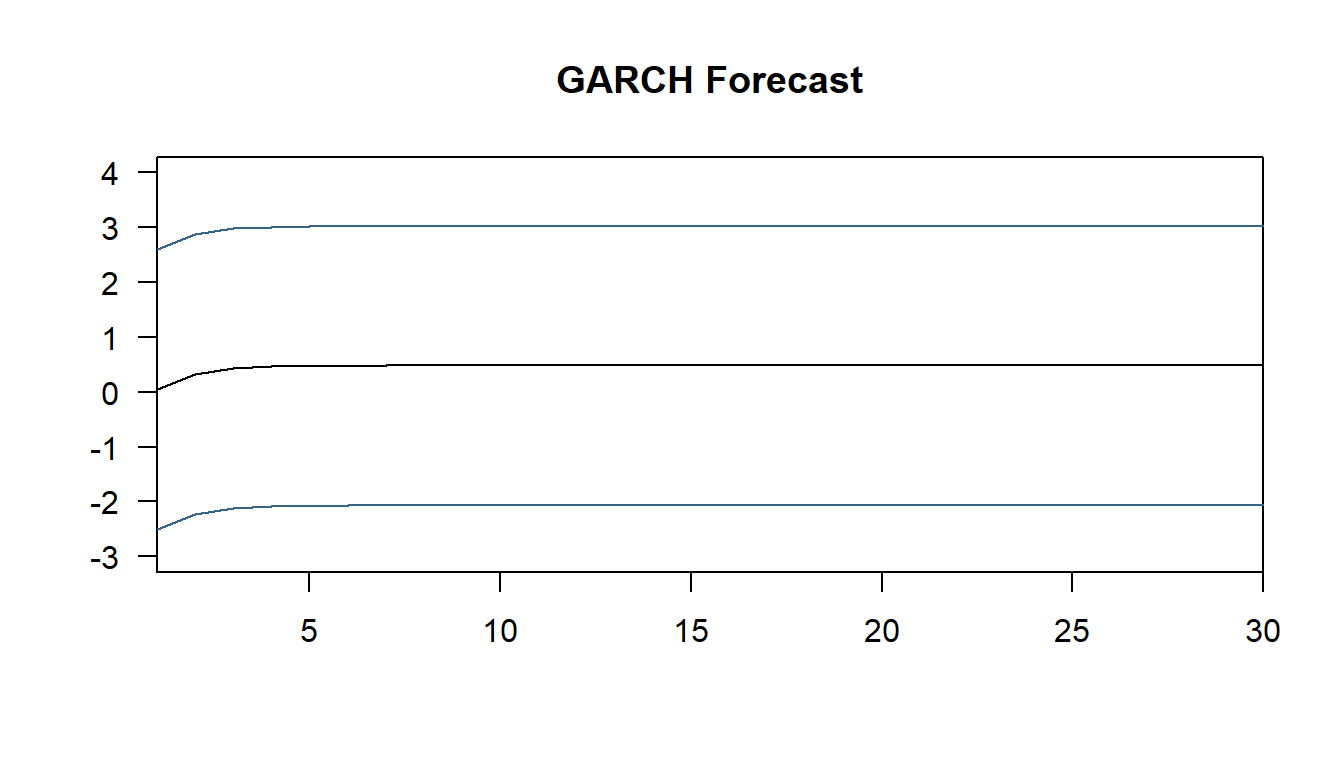

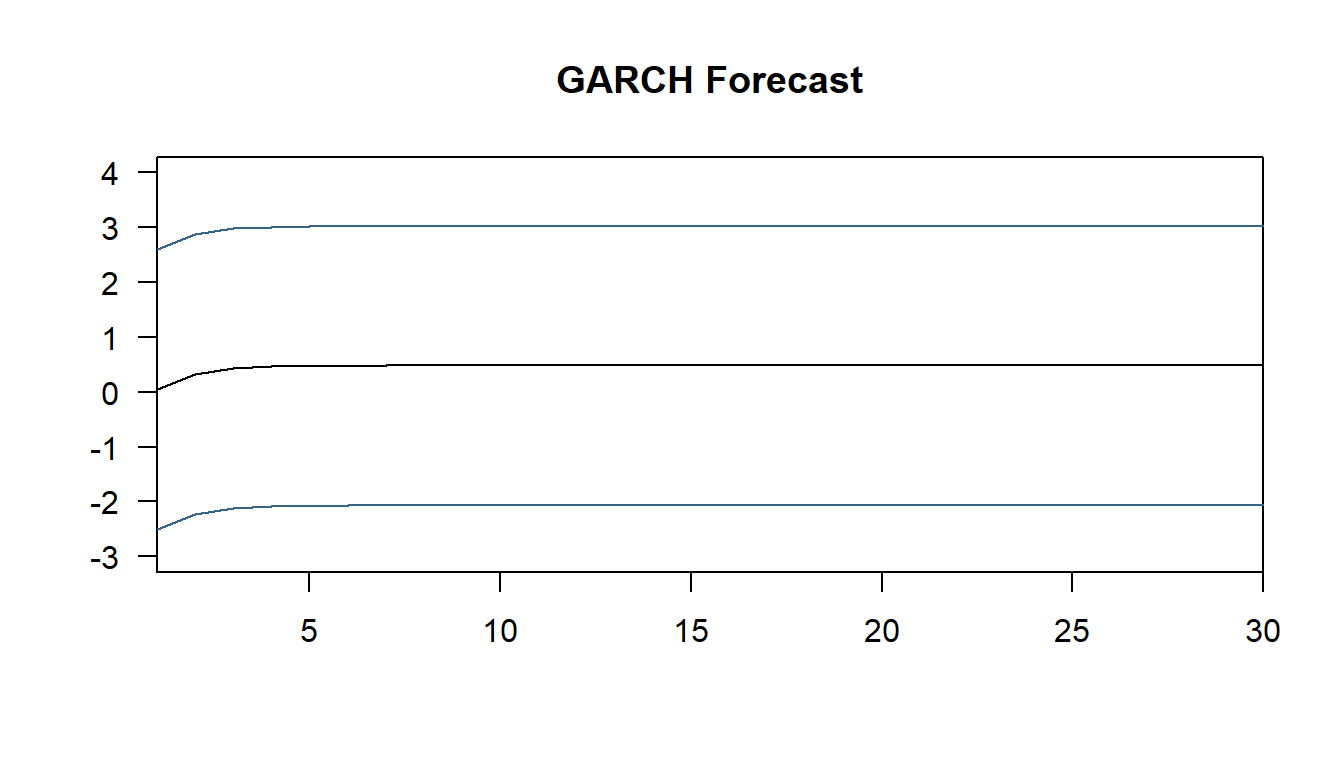

Screenshot 6.3 Dynamic forecasts for the percentage changes in house prices (Page 298)

space <- 30

nfore <- 30

ar2.spec <- ugarchspec(mean.model = list(armaOrder = c(1,0)),

variance.model = list(garchOrder = c(0,1)))

ar.fit <- ugarchfit(ar2.spec, data_ukhp$dhp[1:(nrow(data_ukhp)-space)])

ar.fore <- ugarchforecast(ar.fit, n.ahead = nfore)

c.mean <- ar.fore@forecast$seriesFor

c.lower <- c.mean - qnorm(0.99) * ar.fore@forecast$sigmaFor

c.upper <- c.mean + qnorm(0.99) * ar.fore@forecast$sigmaFor

plot(c.mean, type = "l", xaxs = "i", las = 1, main = "GARCH Forecast",

ylim = c(-3, 4), ylab = "", xlab = "")

lines(c.lower, col = "steelblue4")

lines(c.upper, col = "steelblue4")

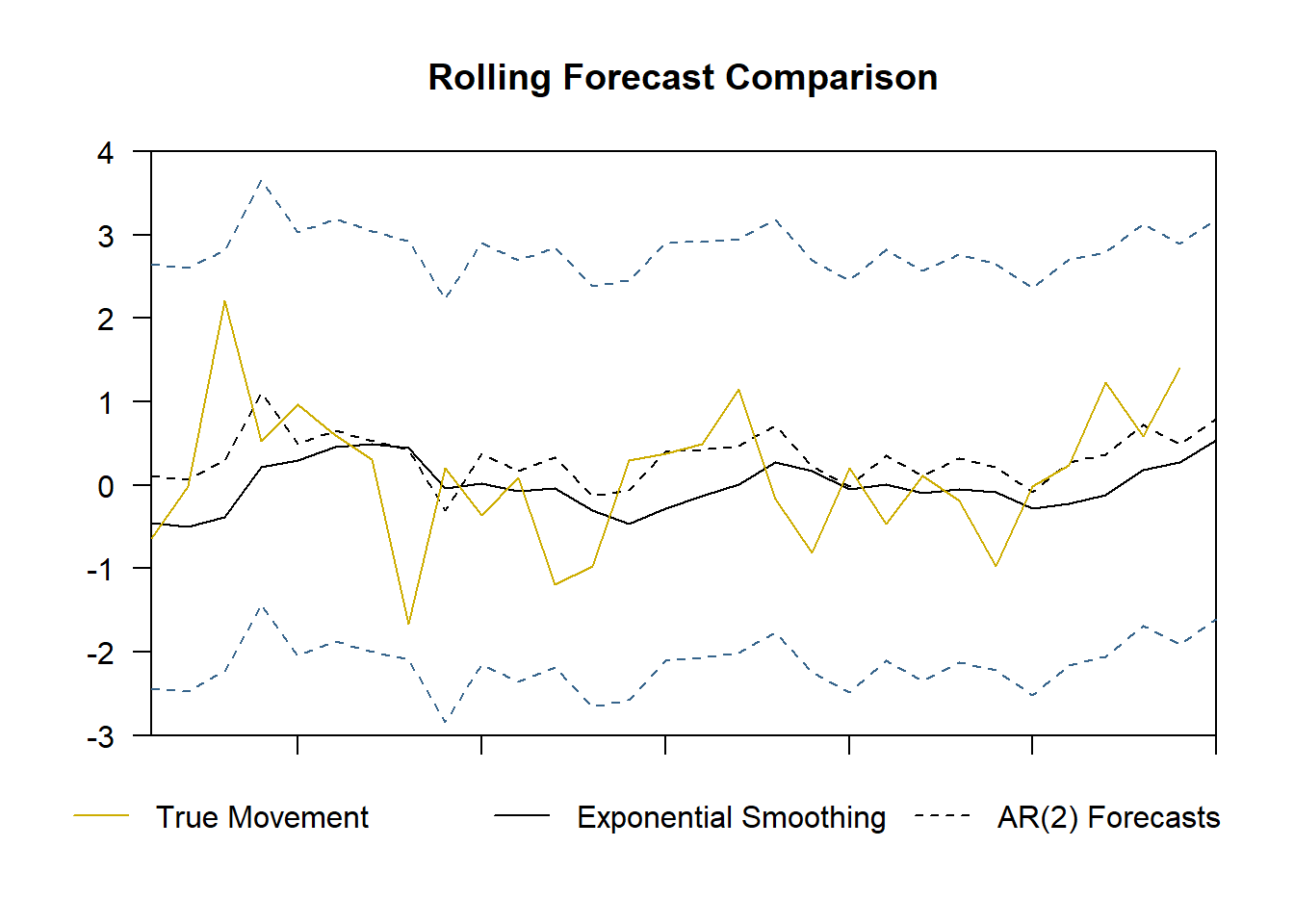

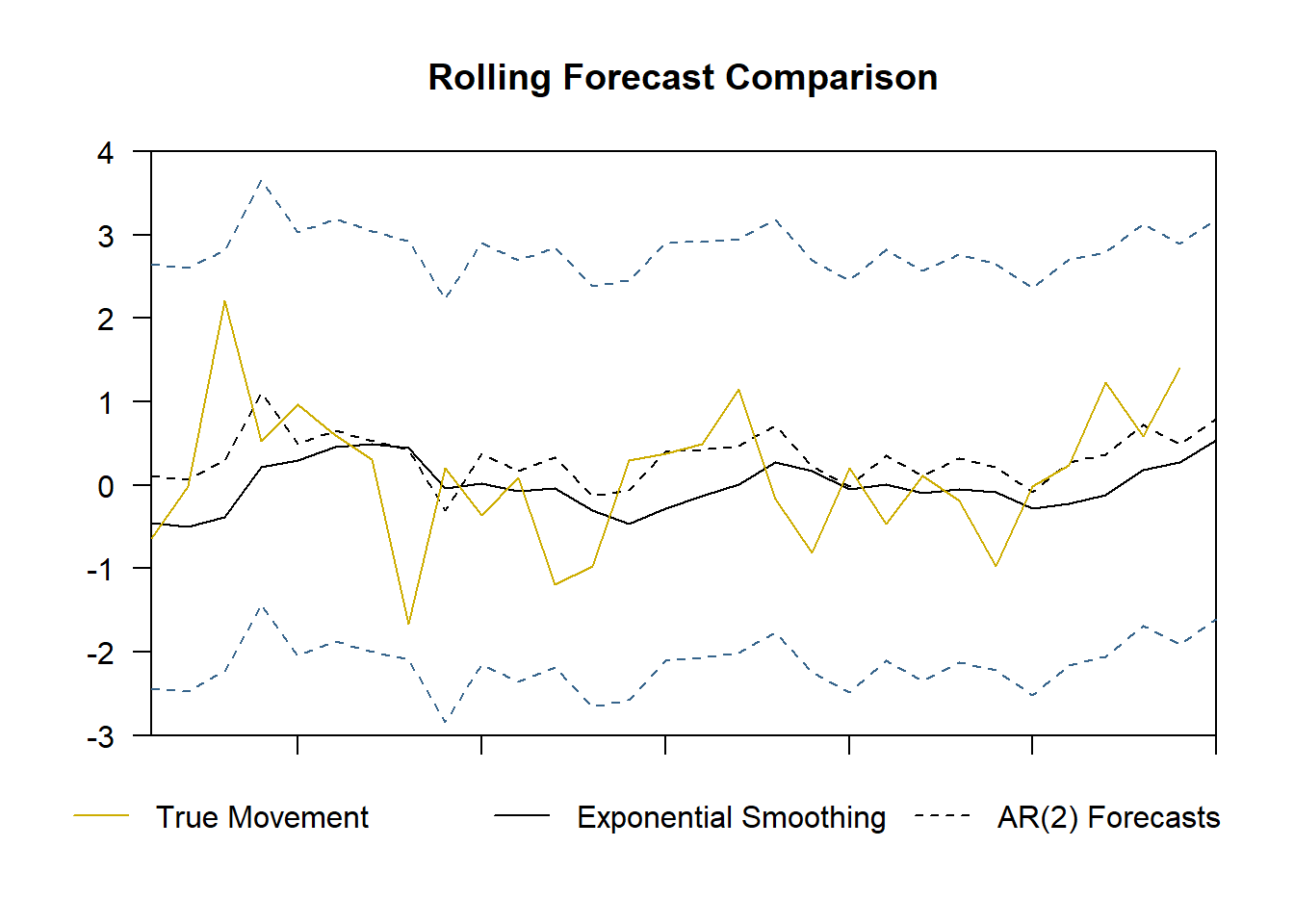

Screenshot 6.4 Static forecasts for the percentage changes in house prices (Page 298)

FORE.EX <- FORE.AR2 <- NULL

for (i in 1:space) {

ar.fit <- ugarchfit(ar2.spec, data_ukhp$dhp[1:(nrow(data_ukhp)-space+i)])

ar.fore <- ugarchforecast(ar.fit, n.ahead = 1)

c.mean <- ar.fore@forecast$seriesFor

c.lower <- c.mean - qnorm(0.99) * ar.fore@forecast$sigmaFor

c.upper <- c.mean + qnorm(0.99) * ar.fore@forecast$sigmaFor

FORE.AR2 <- rbind(FORE.AR2, c(c.mean, c.lower, c.upper))

es.fore <- es(data_ukhp$dhp[1:(nrow(data_ukhp)-space+i)], h = 1, holdout = FALSE, silent = TRUE, intervals = "parametric")

FORE.EX <- rbind(FORE.EX, c(es.fore$forecast, es.fore$lower, es.fore$upper))

}

plot(FORE.EX[,1], type = "l", xaxs = "i", yaxs = "i", las = 1, ylim = c(-3, 4),

main = "Rolling Forecast Comparison", ylab = "", xlab = "")

#lines(FORE.EX[,2], col = "steelblue4")

#lines(FORE.EX[,3], col = "steelblue4")

lines(FORE.AR2[,1], lty = 2)

lines(FORE.AR2[,2], col = "steelblue4", lty = 2)

lines(FORE.AR2[,3], col = "steelblue4", lty = 2)

lines(data_ukhp$dhp[-(1:(nrow(data_ukhp)-space+1))], col = "gold3", lwd = 1)

legend("bottom",

legend = c("True Movement", "Exponential Smoothing", "AR(2) Forecasts"),

col = c("gold3", "black", "black"),

lty = c(1, 1, 2),

box.col = "white",

xpd = TRUE,

inset = c(0, -0.2),

ncol = 3)