CAPM Regression (Page 144)

data_capm <- read.dta("Dataset/capm.dta")

summary(lm1 <- lm(erford ~ ersandp, data = data_capm))

##

## Call:

## lm(formula = erford ~ ersandp, data = data_capm)

##

## Residuals:

## Min 1Q Median 3Q Max

## -48.758 -7.248 -1.305 5.755 63.299

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -0.3199 1.0864 -0.294 0.769

## ersandp 2.0262 0.2377 8.523 2.98e-14 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 12.62 on 133 degrees of freedom

## (1 observation deleted due to missingness)

## Multiple R-squared: 0.3532, Adjusted R-squared: 0.3484

## F-statistic: 72.64 on 1 and 133 DF, p-value: 2.981e-14

Macro Data Regression and Subset Selection (Page 145)

data <- read.dta("Dataset/macro.dta")

dspread <- diff(data$BAAAAASPREAD)

dcredit <- diff(data$CONSUMERCREDIT)

dprod <- diff(data$Industrialproduction)

rmsoft <- 100 * diff(log(data$Microsoft))

rsandp <- 100 * diff(log(data$SANDP))

dmoney <- diff(data$M1MONEYSUPPLY)

inflation <- 100 * diff(log(data$CPI))

term <- data$USTB10Y - data$USTB3M

dinflation <- diff(inflation)

mustb3m <- data$USTB3M / 12

rterm <- diff(term)

ermsoft <- rmsoft - mustb3m[-1]

ersandp <- rsandp - mustb3m[-1]

data=na.omit(data)

summary(lm2 <- lm(ermsoft ~ ersandp + dprod + dcredit + dinflation + dmoney + dspread + rterm, data = data))

##

## Call:

## lm(formula = ermsoft ~ ersandp + dprod + dcredit + dinflation +

## dmoney + dspread + rterm, data = data)

##

## Residuals:

## Min 1Q Median 3Q Max

## -66.985 -3.643 1.105 6.661 26.587

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -1.514e-01 9.048e-01 -0.167 0.8672

## ersandp 1.360e+00 1.566e-01 8.687 <2e-16 ***

## dprod -1.426e+00 1.324e+00 -1.076 0.2825

## dcredit -4.053e-05 7.640e-05 -0.530 0.5961

## dinflation 2.960e+00 2.166e+00 1.366 0.1728

## dmoney -1.109e-02 3.518e-02 -0.315 0.7528

## dspread 5.367e+00 6.914e+00 0.776 0.4382

## rterm 4.316e+00 2.515e+00 1.716 0.0872 .

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 12.66 on 316 degrees of freedom

## Multiple R-squared: 0.2068, Adjusted R-squared: 0.1892

## F-statistic: 11.77 on 7 and 316 DF, p-value: 2.537e-13

Stepwise regression (Page 149)

#Option 1

data2 = na.omit(data)

summary(step(lm(ermsoft ~ ersandp + dprod + dcredit + dinflation + dmoney + dspread + rterm, data = data2), direction = "both"))

## Start: AIC=1652.75

## ermsoft ~ ersandp + dprod + dcredit + dinflation + dmoney + dspread +

## rterm

##

## Df Sum of Sq RSS AIC

## - dmoney 1 15.9 50654 1650.8

## - dcredit 1 45.1 50683 1651.0

## - dspread 1 96.5 50734 1651.4

## - dprod 1 185.7 50823 1651.9

## - dinflation 1 299.2 50937 1652.7

## <none> 50638 1652.8

## - rterm 1 471.8 51109 1653.8

## - ersandp 1 12091.6 62729 1720.1

##

## Step: AIC=1650.85

## ermsoft ~ ersandp + dprod + dcredit + dinflation + dspread +

## rterm

##

## Df Sum of Sq RSS AIC

## - dcredit 1 45.4 50699 1649.2

## - dspread 1 85.2 50739 1649.4

## - dprod 1 174.9 50828 1650.0

## - dinflation 1 311.1 50965 1650.8

## <none> 50654 1650.8

## - rterm 1 492.3 51146 1652.0

## + dmoney 1 15.9 50638 1652.8

## - ersandp 1 12079.7 62733 1718.2

##

## Step: AIC=1649.15

## ermsoft ~ ersandp + dprod + dinflation + dspread + rterm

##

## Df Sum of Sq RSS AIC

## - dspread 1 79.5 50778 1647.7

## - dprod 1 208.1 50907 1648.5

## - dinflation 1 295.3 50994 1649.0

## <none> 50699 1649.2

## - rterm 1 487.8 51187 1650.2

## + dcredit 1 45.4 50654 1650.8

## + dmoney 1 16.2 50683 1651.0

## - ersandp 1 12036.0 62735 1716.2

##

## Step: AIC=1647.65

## ermsoft ~ ersandp + dprod + dinflation + rterm

##

## Df Sum of Sq RSS AIC

## - dprod 1 234.7 51013 1647.2

## - dinflation 1 240.3 51019 1647.2

## <none> 50778 1647.7

## - rterm 1 481.6 51260 1648.7

## + dspread 1 79.5 50699 1649.2

## + dcredit 1 39.7 50739 1649.4

## + dmoney 1 4.9 50774 1649.6

## - ersandp 1 12089.8 62868 1714.8

##

## Step: AIC=1647.15

## ermsoft ~ ersandp + dinflation + rterm

##

## Df Sum of Sq RSS AIC

## - dinflation 1 308.0 51321 1647.1

## <none> 51013 1647.2

## + dprod 1 234.7 50778 1647.7

## - rterm 1 488.2 51501 1648.2

## + dspread 1 106.0 50907 1648.5

## + dcredit 1 72.5 50941 1648.7

## + dmoney 1 0.0 51013 1649.2

## - ersandp 1 12186.6 63200 1714.5

##

## Step: AIC=1647.1

## ermsoft ~ ersandp + rterm

##

## Df Sum of Sq RSS AIC

## <none> 51321 1647.1

## + dinflation 1 308.0 51013 1647.2

## + dprod 1 302.4 51019 1647.2

## - rterm 1 448.3 51769 1647.9

## + dcredit 1 59.3 51262 1648.7

## + dspread 1 35.9 51285 1648.9

## + dmoney 1 3.2 51318 1649.1

## - ersandp 1 12167.6 63489 1714.0

##

## Call:

## lm(formula = ermsoft ~ ersandp + rterm, data = data2)

##

## Residuals:

## Min 1Q Median 3Q Max

## -66.806 -3.909 1.080 6.253 29.637

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -0.6858 0.7037 -0.975 0.331

## ersandp 1.3372 0.1533 8.724 <2e-16 ***

## rterm 4.1815 2.4970 1.675 0.095 .

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 12.64 on 321 degrees of freedom

## Multiple R-squared: 0.1961, Adjusted R-squared: 0.1911

## F-statistic: 39.15 on 2 and 321 DF, p-value: 6.094e-16

# Option 2

library(olsrr)

# Fit the initial model

model <- lm(ermsoft ~ ersandp + dprod + dcredit + dinflation + dmoney + dspread + rterm, data = data2)

# Run stepwise regression with p-value thresholds

ols_step_both_p(model, prem = 0.2, add = 0.2)

##

##

## Stepwise Summary

## -----------------------------------------------------------------------------

## Step Variable AIC SBC SBIC R2 Adj. R2

## -----------------------------------------------------------------------------

## 0 Base Model 2635.292 2642.853 1715.376 0.00000 0.00000

## 1 ersandp (+) 2569.387 2580.729 1649.926 0.18908 0.18656

## 2 rterm (+) 2568.569 2583.692 1649.166 0.19610 0.19109

## -----------------------------------------------------------------------------

##

## Final Model Output

## ------------------

##

## Model Summary

## -----------------------------------------------------------------

## R 0.443 RMSE 12.586

## R-Squared 0.196 MSE 158.398

## Adj. R-Squared 0.191 Coef. Var -4059.606

## Pred R-Squared 0.183 AIC 2568.569

## MAE 7.528 SBC 2583.692

## -----------------------------------------------------------------

## RMSE: Root Mean Square Error

## MSE: Mean Square Error

## MAE: Mean Absolute Error

## AIC: Akaike Information Criteria

## SBC: Schwarz Bayesian Criteria

##

## ANOVA

## ----------------------------------------------------------------------

## Sum of

## Squares DF Mean Square F Sig.

## ----------------------------------------------------------------------

## Regression 12519.039 2 6259.520 39.152 0.0000

## Residual 51321.051 321 159.879

## Total 63840.090 323

## ----------------------------------------------------------------------

##

## Parameter Estimates

## ---------------------------------------------------------------------------------------

## model Beta Std. Error Std. Beta t Sig lower upper

## ---------------------------------------------------------------------------------------

## (Intercept) -0.686 0.704 -0.975 0.331 -2.070 0.699

## ersandp 1.337 0.153 0.437 8.724 0.000 1.036 1.639

## rterm 4.181 2.497 0.084 1.675 0.095 -0.731 9.094

## ---------------------------------------------------------------------------------------

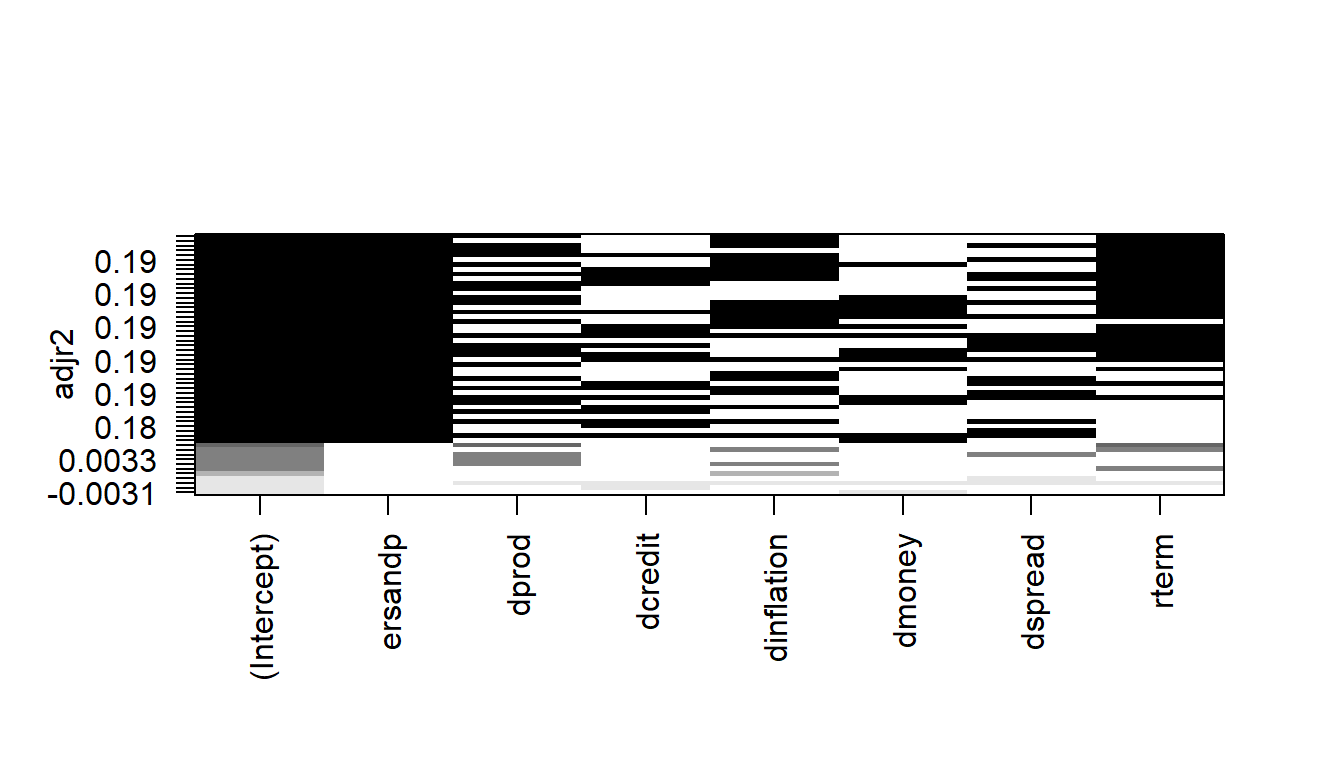

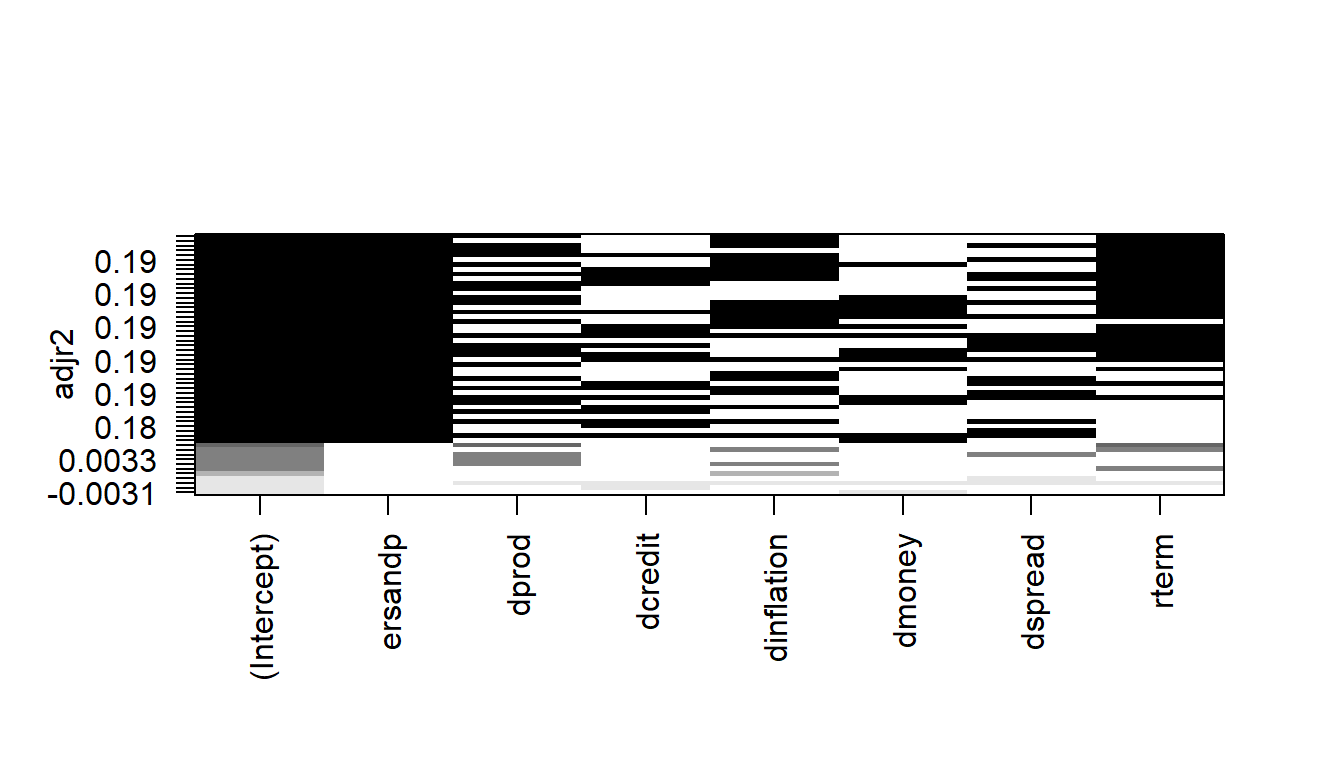

Model Selection Plot (Page 149)

leaps <- regsubsets(ermsoft ~ ersandp + dprod + dcredit + dinflation + dmoney + dspread + rterm, data = data2, nbest = 10)

plot(leaps, scale = "adjr2")

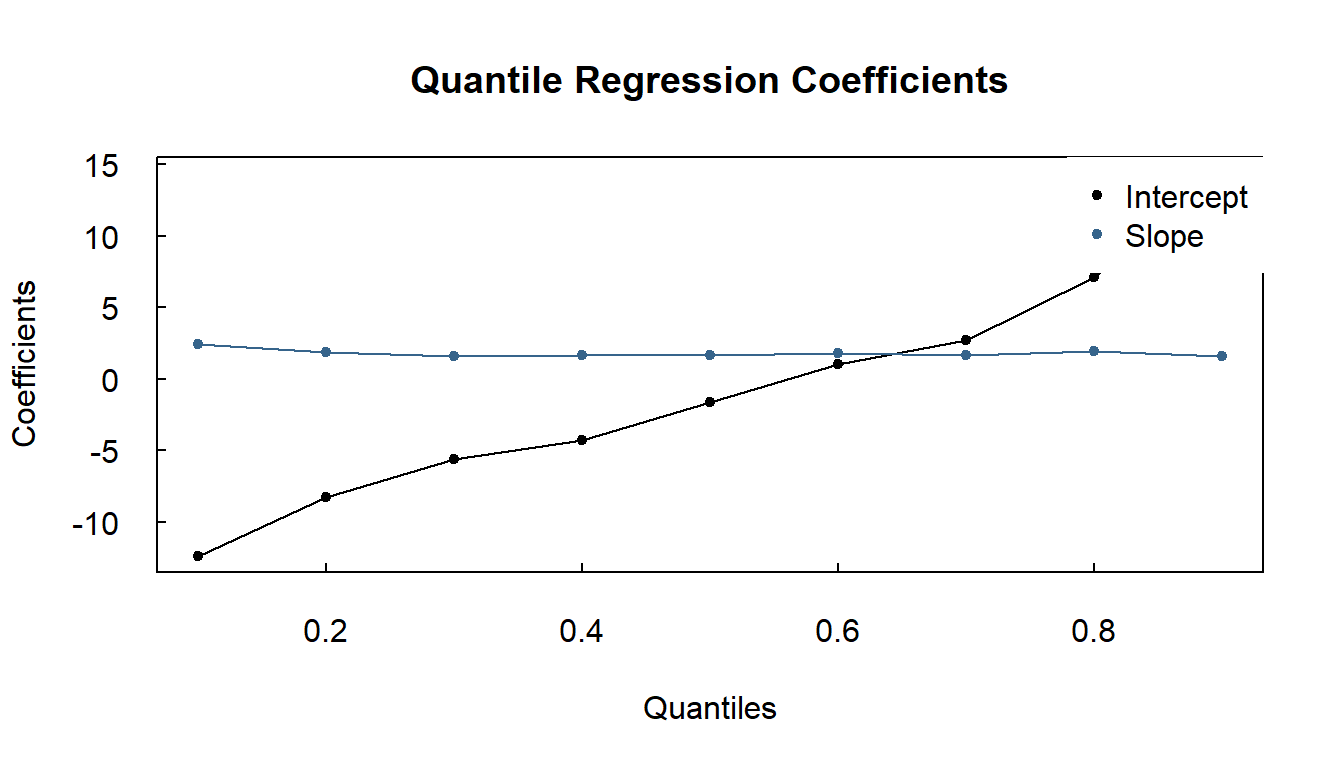

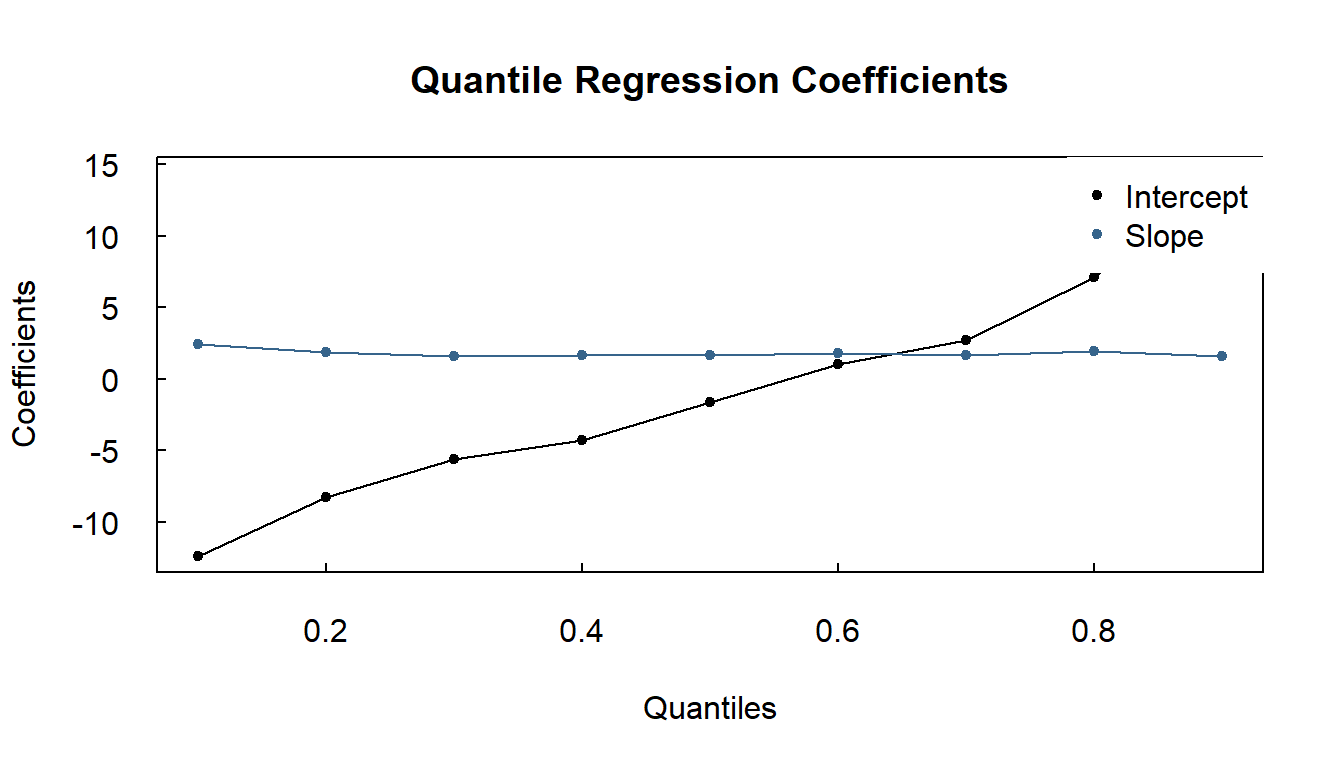

Quantile Regression (Page 165)

data_capm <- read.dta("Dataset/capm.dta")

BETA <- sapply(seq(0.1, 0.9, by = 0.1), function(tau) {

coef(rq(erford ~ ersandp, data = data_capm, tau = tau))

})

summary(BETA)

## V1 V2 V3 V4 V5

## Min. :-12.425 Min. :-8.2948 Min. :-5.5927 Min. :-4.2950 Min. :-1.62658

## 1st Qu.: -8.719 1st Qu.:-5.7596 1st Qu.:-3.7946 1st Qu.:-2.8035 1st Qu.:-0.80512

## Median : -5.013 Median :-3.2245 Median :-1.9965 Median :-1.3121 Median : 0.01635

## Mean : -5.013 Mean :-3.2245 Mean :-1.9965 Mean :-1.3121 Mean : 0.01635

## 3rd Qu.: -1.307 3rd Qu.:-0.6893 3rd Qu.:-0.1983 3rd Qu.: 0.1794 3rd Qu.: 0.83781

## Max. : 2.399 Max. : 1.8458 Max. : 1.5998 Max. : 1.6709 Max. : 1.65927

## V6 V7 V8 V9

## Min. :1.039 Min. :1.652 Min. :1.971 Min. : 1.615

## 1st Qu.:1.222 1st Qu.:1.924 1st Qu.:3.257 1st Qu.: 4.821

## Median :1.404 Median :2.196 Median :4.543 Median : 8.026

## Mean :1.404 Mean :2.196 Mean :4.543 Mean : 8.026

## 3rd Qu.:1.586 3rd Qu.:2.467 3rd Qu.:5.829 3rd Qu.:11.232

## Max. :1.768 Max. :2.739 Max. :7.116 Max. :14.438

plot(seq(0.1, 0.9, 0.1), BETA[1, ], type = "o", las = 1, pch = 20,

xlab = "Quantiles", ylab = "Coefficients", main = "Quantile Regression Coefficients", tck = 0.02)

points(seq(0.1, 0.9, 0.1), BETA[2, ], type = "o", col = "steelblue4", pch = 20)

legend("topright", legend = c("Intercept", "Slope"), col = c("black", "steelblue4"), pch = 20, box.col = "white")

Eigenvalue Analysis (Page 175)

data <- read.dta("Dataset/macro.dta")

interest_rates <- data[, c("USTB3M", "USTB6M", "USTB1Y", "USTB3Y", "USTB5Y", "USTB10Y")]

cor_matrix <- cor(interest_rates)

eigen_results <- eigen(cor_matrix)

eigen_results$vectors

## [,1] [,2] [,3] [,4] [,5] [,6]

## [1,] -0.4066368 -0.4482369 0.5146117 -0.4606699 -0.31374158 0.24135964

## [2,] -0.4089605 -0.3963105 0.1013554 0.1983160 0.49874699 -0.61427894

## [3,] -0.4121447 -0.2712975 -0.3164404 0.5987738 -0.05905395 0.54257020

## [4,] -0.4143717 0.1175832 -0.5612330 -0.2183381 -0.53942127 -0.40104989

## [5,] -0.4098192 0.3646077 -0.2212300 -0.4656201 0.57610655 0.31853709

## [6,] -0.3973398 0.6493495 0.5107271 0.3541896 -0.16265369 -0.08784986

## [1] 5.7917388755 0.1973202793 0.0080995259 0.0022349759 0.0004044343 0.0002019091

diff(eigen_results$values)

## [1] -5.5944185961 -0.1892207534 -0.0058645500 -0.0018305416 -0.0002025251

variance_proportions <- eigen_results$values / sum(eigen_results$values)

variance_proportions

## [1] 9.652898e-01 3.288671e-02 1.349921e-03 3.724960e-04 6.740571e-05 3.365152e-05

cumulative_variance <- cumsum(variance_proportions)

cumulative_variance

## [1] 0.9652898 0.9981765 0.9995264 0.9998989 0.9999663 1.0000000